Federal Housing Administration officials denied reports showing the agency would face mounting losses and eventually require a taxpayer bailout, the Wall Street Journal reported, and said it continues to generate more revenue than expenses.

The FHA said it would have $2.6 billion in reserves even after taking into account expected losses on the $1.1 trillion of mortgages it guarantees, assuming housing prices fall 5.6 percent next year and then begin to rise. Once those prices rise, the FHA believes it will be able to replenish its reserve funds very quickly. Further, because of increased insurance premiums and declining severe delinquency rates, the agency takes in more money that it pays out.

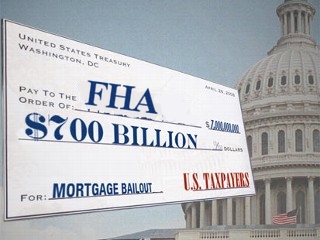

The statements follow a report last week that showed the agency was in jeopardy of losing $50 billion and requiring a taxpayer bailout because of it underestimates the riskiness of it mortgages and the potential for losses by billions. But the FHA called the report “irresponsible” and said it has loaned to far more stable buyers in recent years. [WSJ]