Credit: PwCReal estate investors believe the office market is a smart investment play, as they project high tenant retention and rent growth in 2012, according to a fourth-quarter survey of investors released today by PricewaterhouseCoopers.

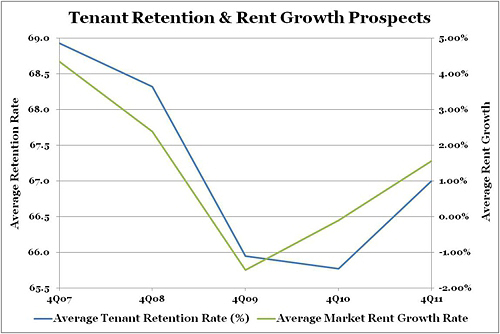

Investors like the capitalization rates offered by office properties, as they remain “favorably priced” in many markets, according to Mitch Roschelle, a partner of PwC’s U.S. real estate advisory practice. “The bullishness on the part of investors in the office sector comes as more office tenants are staying put and prospects for rent growth are improving,” he said.

Tenants tend not to move during periods of rent increases, the report notes, making office properties stable assets. Rent growth is projected to be most significant in cities with strong technology and energy sectors such as New York, San Francisco and the Pacific Northwest. At the same time, investors have turned bearish on government-dependent Washington, D.C., as the public sector is expected to shrink.

As cap rates begin to decrease, which they are expected to do in 22 of the 31 surveyed markets, investors will begin turning to secondary office markets to increase yields, the survey predicts.

Additionally, the surveyed investors expressed a belief that apartment development would boom in 2012, as vacancy rates and homeownership rates decrease and rents skyrocket. Financing for construction in the extremely hot rental sector is becoming easier to secure, according to Susan Smith, editor-in-chief of the survey. — Adam Fusfeld