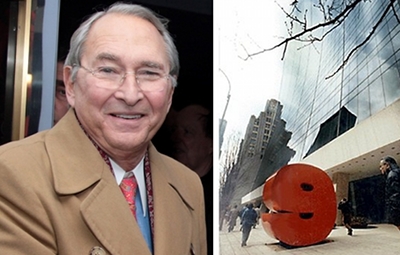

From left: Sheldon Solow and 9 West 57th StreetDeveloper Sheldon Solow has obtained a $625 million loan on 9 West 57th Street from Deutsche Bank, which beat out AIG and JPMorgan Chase to provide financing for the trophy property, Bloomberg News reported.

The loan refinances debt set to mature in February that Solow took out at the height of the bubble in 2007. About $55 billion of property loans are set to come due in 2012, and $19 billion of them were originated at the height of the bubble. But most of them will struggle to refinance, Standard & Poor’s predicted, as property values have decreased about 42 percent from the peak.

In this case, several parties competed for Solow’s refinancing because of the location and prestige of the building, exemplifying the demand for prime buildings, Bloomberg said. The 50 story building just west of Fifth Avenue is worth about $1.5 billion, according to Real Capital Analytics.

Though the 1.6 million square foot office building has substantial vacancies, much of that is due to Solow’s unwillingness to come down on rents, which remain among the highest in all of Manhattan.

“He’s fortunate enough to have very low leverage on the building which allows him to carry the vacancy,” said Dan Fasulo, a managing director at Real Capital Analytics. “He could lease those floors tomorrow if he wanted too.” [Bloomberg News]