As rising rents in desirable neighborhoods encourage landlords to convert non-market-rate homes to market rate units, a massively disproportionate volume of the city’s affordable housing is shifting to impoverished and low-opportunity neighborhoods, according to a new report by the NYU Furman Center.

On average, neighborhoods that lost affordable units between 2002 and 2011 had rents of $400 more per month than neighborhoods where affordable housing was preserved, the report found. Neighborhoods converting more apartments to market-rate also tended to have better public schools, lower poverty rates, lower violent crime rates, and better access to jobs requiring an associate degree or lower.

During this same period, the city’s newly constructed affordable units were located, on average, in neighborhoods with a violent crime rate in the top fifth of neighborhoods, a poverty rate over 30 percent, and a local public school where just 40 percent of students performed at grade level in language arts, according to the report.

“Rising market rents in a neighborhood make exits from affordability restrictions more likely, and they also may make preservation more expensive for the city,” said Max Weselcouch, director of the Moelis Institute for Affordable Housing Policy at the Furman Center. “Still, the need for affordable units greatly exceeds the supply, and preserving units in a range of neighborhoods—low-cost and high-cost—may allow the city to spread its subsidy dollars further.”

Building more affordable housing is central to Mayor Bill de Blasio’s agenda, and his administration has committed to building or preserving 200,000 units over the next decade.

Since 2000, only 6 percent of the city’s subsidized housing has been constructed in Manhattan Below 96th Street, and of these, all have been in mixed-income 80/20 projects. As a comparison, in the 1970s, 17 percent of the city’s new affordable housing was constructed below 96th Street.

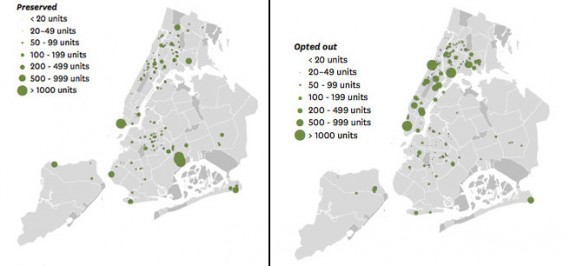

Over the next decade, 58,288 subsidized units will become eligible to opt out of affordability restrictions, many of them located in high-amenity neighborhoods. The report notes that landlords with buildings in shabbier condition might be less likely to convert to market-rate, driving the overall quality of affordable housing down.

Currently, the city’s largest concentrations of subsidized housing are located in Upper Manhattan, the South Bronx, and Central Brooklyn.