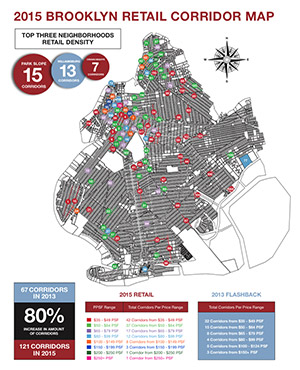

With more than 19,000 new residential unit permits filed last year and an office vacancy rate of 4.2 percent — the lowest in the nation — Brooklyn added 27 new retail corridors last year for a total of 121, nearly double the number from two years ago, according to commercial brokerage CPEX’s newest annual retail report, which The Real Deal has a first look at.

An influx of new residents to Bedford-Stuyvesant and the changing office landscape in Sunset Park created new retail landscapes in the Brooklyn neighborhoods last year, according to CPEX.

“The growth of retail corridors in Brooklyn over the past two years has been huge, fueled by a number of non-retail drivers, such as an increase in residential development and an exceptionally low office vacancy rate,” said Ryan Condren, managing director of CPEX’s retail team. “As more retailers flock to the borough, we are not only seeing an increase in the total number of retail corridors, but also a significant jump in price as well, with two corridors at over two hundred dollars per square foot for the first time ever.”

In Sunset Park, CPEX represented Salmar Properties’ Liberty View Industrial Plaza, where Bed Bath & Beyond signed the borough’s largest retail lease in 2014 at approximately 120,000 square feet. In addition, Jamestown Properties’ 16-building, six-million square foot Industry City is transforming the once industrial section along the waterfront into an office and manufacturing destination.

And as residential demand has surged in Bed-Stuy, 33 new retail locations opened in the neighborhood last year, 28 of which were restaurants, cafes or bars.

In addition, six new retail stretches were created from the division of existing corridors.

The borough’s priciest strip continues to be Downtown’s Fulton Street Mall, where rents exceed $250 per square foot. Williamsburg’s Bedford Avenue ranks second with rents ranging from $200 to $250 per square foot. The influx of retailers like Whole Foods, Blue Bottle and Steven Alan Home has poised the nearby North 4th Street to experience marked growth in the near future, CPEX said. North 4th Street is one of eight retail corridors where rents range from $100 to $149 per square foot.

“This is the prime example of a side street that not so long ago had zero retail traction,” the report stated, “but is now incredibly one of the more expensive blocks in the borough.”