The latest batch of market reports found that Lower Manhattan’s commercial market had its best year on record since the financial crisis; office asking rents fells in January; and sales for apartments reached record levels in the fourth quarter of the year.

Office Leasing

February 2015 Manhattan office: DTZ

Manhattan asking rents fell and availability increased, contributing to sluggish office leasing activity in January, according to a monthly office report from DTZ. The availability rate increased to 9.9 percent, as 11 buildings added nearly 45,000 square feet of space to the market in the first month of the new year. View the full report here.

February 2015 Manhattan Midtown office: CBRE

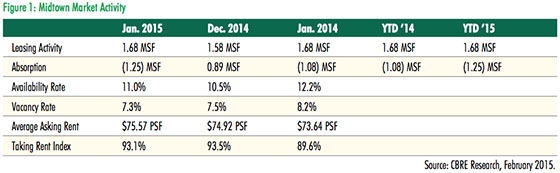

Midtown leasing totaled 1.68 million square feet in January, and was 28 percent higher than the five-year monthly average, according to a monthly office report from CBRE. While leasing activity remained the same year-over-year, totals were up from 1.58 million square feet in December 2014. View the full report here.

4Q 2014 Manhattan market overview: Avison Young

The Manhattan office market continued its strong recovery in the fourth quarter of 2014. Meanwhile, investment sales totaled $38.5 billion for the year, marking the third highest year ever recorded, according to a report from Avison Young. View the full report here.

Investment Sales

2014 New York City multifamily: Ariel Property Advisors

New York City multifamily sales in 2014 totaled $12.6 billion from 761 transactions and 1,413 buildings, according to a year-end report from Ariel Property Advisors. Dollar volume increased 39 percent, transaction volume was up eight percent and building volume increased 13 percent compared to the previous year. View the full report here.

2014 Lower Manhattan real estate: Downtown Alliance

Lower Manhattan’s commercial market had its best year on record in 2014 since the financial crisis. Retail expansion drove commercial property sales and the area’s hotel boom continued, according to a year-end report from Downtown Alliance. View the full report here.

Residential Sales

February 2015 Manhattan residential sales: CityRealty

Sales for co-ops and condominiums in Manhattan grossed $3.3 billion in December, and the month was most notable for high-priced units, including the city’s most expensive sale which closed in the final month of the year, according to CityRealty’s monthly market report. Condo sales averaged $2.9 million from 410 units sold, and had an average price of $1,741 per square foot. View the full report here.

4Q 2014 Manhattan residential: Brown Harris Stevens

Sales for Manhattan apartments reached record levels in the fourth quarter of 2014, according a report from Brown Harris Stevens. Prices hit $1.72 million the final quarter, an 8 percent increase from the previous record of $1.7 million set in the first quarter of 2014. View the full report here.

Manhattan luxury contracts Feb. 9-15, 2015: Olshan Realty

Twenty-eight contracts were signed last week for apartments priced at $4 million and above, according to a report from Olshan Luxury Market. The total weekly average asking price was $7.8 million and the asking price for the week totaled $219.9 million. View the full report here.