Values in New York City’s luxury market have grown more in the past year than values in competing global markets, according to a recent wealth report from global property consultancy Knight Frank.

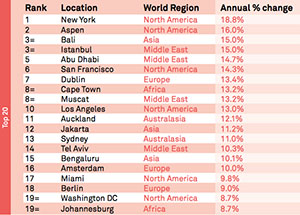

The Prime International Residential Index, which measures the performance of prime real estate in the world’s top luxury cities and second-home markets, shows that the prices of New York luxury product increased by 18.8 percent during 2014, topping the list of locations.

Of the ten markets where luxury values appreciated the most, four are located in the U.S. — Aspen is ranked second with 16 percent growth, San Francisco is sixth with 14.3 percent growth, and Los Angeles is 10th with 13 percent growth.

The report notes that the threat of Mayor Bill de Blasio’s pied-ả-terre tax doesn’t appear to have discouraged ultra-high-net-worth individuals from buying second homes in New York, but London has seen growth curtailed in prices of properties valued over £2 million ($2.95 million) due to a new “stamp duty,” or purchase tax, limiting the value increase there to just 5.1 percent.

Overall, U.S. luxury real estate had a stellar year, increasing in value almost 13 percent nationwide, while worldwide values rose 2 percent and top European cities saw just 2.5 percent growth.

Other top performers were Bali in Indonesia and Istanbul in Turkey. In both markets, luxury prices increased 15 percent.

Jakarta, last year’s top-ranked city, slipped to 12th place this year with growth of 11.2 percent, which the report says is typical of the luxury market slowdown in many Asian cities last year.

Dubai, which was once a frontrunner with 17 percent growth in 2013, slowed to 0.3 percent growth, partially due to the Central Bank of the United Arab Emirates’ mortgage cap, while government policies in China that have been aimed at controlling values also slowed growth in the biggest luxury markets there, such as Shanghai (0 percent), Beijing (-0.5 percent) and Guangzhou (0.6 percent).