Manhattan rents continued their upward climb in March, while Brooklyn’s dipped slightly for the second month in a row, according to the latest rental market report by Douglas Elliman.

Median Manhattan rents increased for the 13th month in a row, reaching $3,395, a 6.1 percent increase over the same period last year. The average increased 4 percent to $4,126.

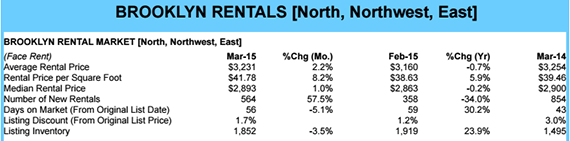

In Brooklyn, the median fell .2 percent to $2,893 after declining .9 percent last month. The average in the borough decreased .7 percent to $3,231. Luciane Serifovic, executive vice president and director of rentals for Douglas Elliman, attributed the decrease partially to a surplus of inventory.

“A lot of new development buildings have been built there and a lot of them went up at the same time. That definitely has had an impact on the rent decreases in Brooklyn,” she said, adding that it is probably not the start of a substantial decline. “I really don’t foresee a significant drop with Brooklyn rents.”

(credit: Douglas Elliman and Miller Samuel)

However, the gap between rental prices in the two boroughs has widened since last year, with median Brooklyn rents now $502 cheaper than Manhattan, compared to $300 last year.

With the tight market for credit and continued employment growth, Serifovic said she notices clients in higher income brackets looking to rent, with many of them considering Manhattan to be their first choice.

“They do have the ability to purchase but they are opting to rent,” she said.

In Manhattan, studio and one-bedroom units saw the biggest rent increases, while the median price for a three-or-more-bedroom unit dropped 15.6 percent.

Additionally, vacancy rates in Manhattan increased to 2.38 percent from 1.68 percent, which Serifovic said could be due to landlords’ preference for putting units on the market in the spring and summer, rather than due to any decrease in demand. She noted that landlords tinker with lease lengths to ensure that they end during the warmer months when new residents are moving to the city.

The report’s author, Jonathan Miller of real estate appraisal firm Miller Samuel, was not immediately available to comment.