Commercial real estate services firm DTZ is buying Cushman & Wakefield for $2 billion.

Combined, the firm will have more than $5 billion in annual revenue, the Wall Street Journal reported. The combined firm will keep the Cushman & Wakefield name and will have more than 250 offices in 50 different countries.

The firm will also create a real competitor for CBRE and JLL, the two commercial real estate services firms that have been dominating the field. CBRE has $9 billion in annual revenue and JLL has $5.4 billion, according to the newspaper.

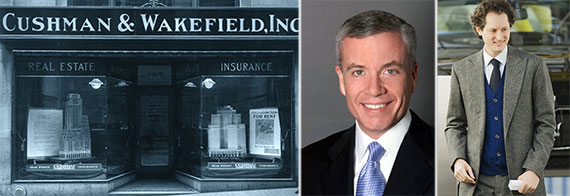

From left: Cushman & Wakefield office, Edward Forst and John Ellkann

The Agnelli family’s Exor SpA is selling Cushman & Wakefield, which was founded in 1917. In January, DTZ, which is backed by private equity firm TPG, bought brokerage Cassidey Turley for $557 million. Late last year, Cushman & Wakefield bought sales brokerage Massey Knakal Realty Services for $100 million.

Former CBRE chief executive Brett White will head up the newly combined firm. DTZ’s current chief, Tod Lickerman, will become the firm’s president.

The new firm will provide the industry — which White described as ” a bit of a two-horse race” to the Wall Street Journal — with a “third formidable competitor at the highest end of this industry,” White told the newspaper. [WSJ] — Claire Moses