Aby Rosen’s luxury condominium at 100 East 53rd Street will have an average sales price of more than $4,000 per square foot, according to an offering plan filed with the Attorney General’s office.

Located next to Rosen’s iconic Seagram Building, the 61-story tower will have 99 total units and a sellout of $761.8 million, including a $55 million penthouse, according to the offering plan, which was reviewed by The Real Deal.

According to the offering plan, which is yet to be approved, prices start at $3.3 million for a 1,140-square-foot one-bedroom on the fifth floor of the Norman Foster-designed tower.

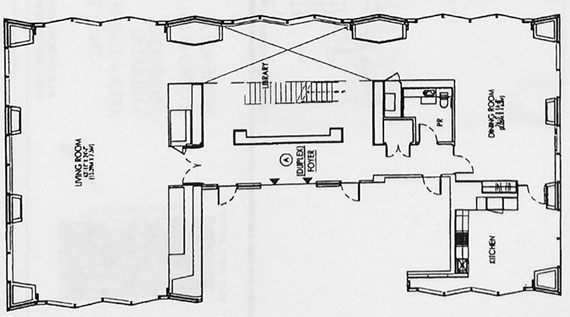

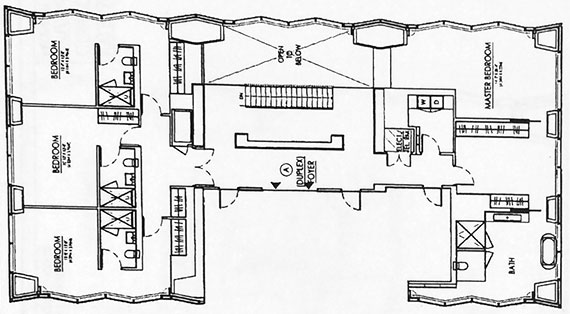

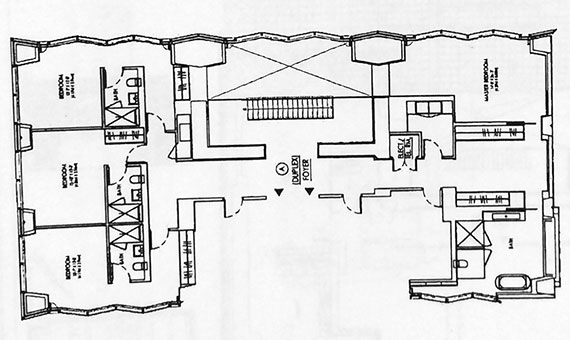

The most expensive unit is a duplex on the top two floors of the building, asking $55 million, or just over $8,100 per square foot. Another duplex, on floors 10 and 11, will ask $35 million, or just under $5,300 per square foot.

The building will also have 11 full-floor units, on floors 48 through 58. Measuring 3,385 square feet, they will start at $18.5 million, or just under $5,500 per square foot. Unit 58A will ask $22.6 million, nearly $6,700 per square foot.

After weathering years of delays, Rosen’s RFR Holding brought Hines and China Vanke, the largest publicly traded developer in China, on board as partners last year. In March, China Cinda paid $140.5 million for a majority stake in the project.

Last month, the developers secured a $360 million loan from the Industrial and Commercial Bank of China to finance the development of the new luxury tower.

According to plans filed with the city’s Department of Buildings, 100 East 53rd will have a lounge and library on the third floor, as well as a swimming pool, gym and yoga studio on the fourth floor. Compass is marketing the project.

The building will also have 50 storage licenses, being offered for $20,000 per license, and 55 bicycle storage licenses, being offered for $3,000 each, according to the offering plan.