Commercial real estate brokerages like to disclose a lot of things: their biggest deals, their newest hires and photos from their posh events. One thing they always stay mum about is the wages they pay their employees. But thanks to a new tool for looking at federal immigration data, that veil of secrecy is showing some holes.

U.S. Visa Explorer, a site that aggregates wage data from thousands of foreign workers in the United States on an H1-B work visa, launched Friday. It offers fascinating insights into employment trends and salaries at certain companies, including major commercial real estate firms like JLL, CBRE and Cushman & Wakefield. All firms that The Real Deal reached out to either declined to comment or didn’t respond by press time.

(Related: In 2012, TRD looked at compensation across several facets of the industry. Read the article, “Paycheck Confidential,” here.)

Here’s how it works: The H1-B program is the most common work visa used to hire skilled foreign labor. When a company applies for a visa for one of its employees, it is required to disclose the employee’s salary, and that information is publicly available. As Buzzfeed first reported, a man named Theo Negri decided to aggregate that data and created U.S. Visa Explorer.

The numbers offer clues on how the real estate labor market has changed over the past few years. Take, for example, the number of H-1B applications filed over the years by commercial real estate firms with a leading presence in New York. (see graph above).

The graph shows that hiring of foreign workers fell significantly in 2008 and 2009 amid a tanking real estate market. H1-B applications picked up slightly in 2010, fell again in 2011 and 2012, before growing dramatically in 2013 and 2014.

Hiring workers through the H-1B program is expensive and tedious (take it from someone who has gone through the process), and firms generally only do it if they can’t find a suitable U.S. worker for a position. This means H-1B applications are a useful barometer of how tight the labor market in U.S. commercial real estate is. As layoffs increased in 2008 and 2009, companies likely had a relatively easy time filling positions with idle U.S. workers, and had less cash to spare for expensive visa applications. Unsurprisingly, the number of H-1B applications declined. But as real estate prices and hiring picked up in 2013 and 2014, companies once again have an incentive to look abroad.

Another possible reason for the uptick in applications is that the skills of foreign workers (for example languages or connections abroad) are increasingly valuable as the U.S. real estate market becomes more globalized.

The federal data also shows wages listed in H1-B applications, offering insights into pay at major firms. There are a lot of caveats here — the data does not reveal seniority of workers or the kind of workers hired. Moreover, the average pay for foreign workers may well be much higher than for the industry as a whole (for legal reasons it can’t be lower). Nonetheless, there are interesting observations to be made.

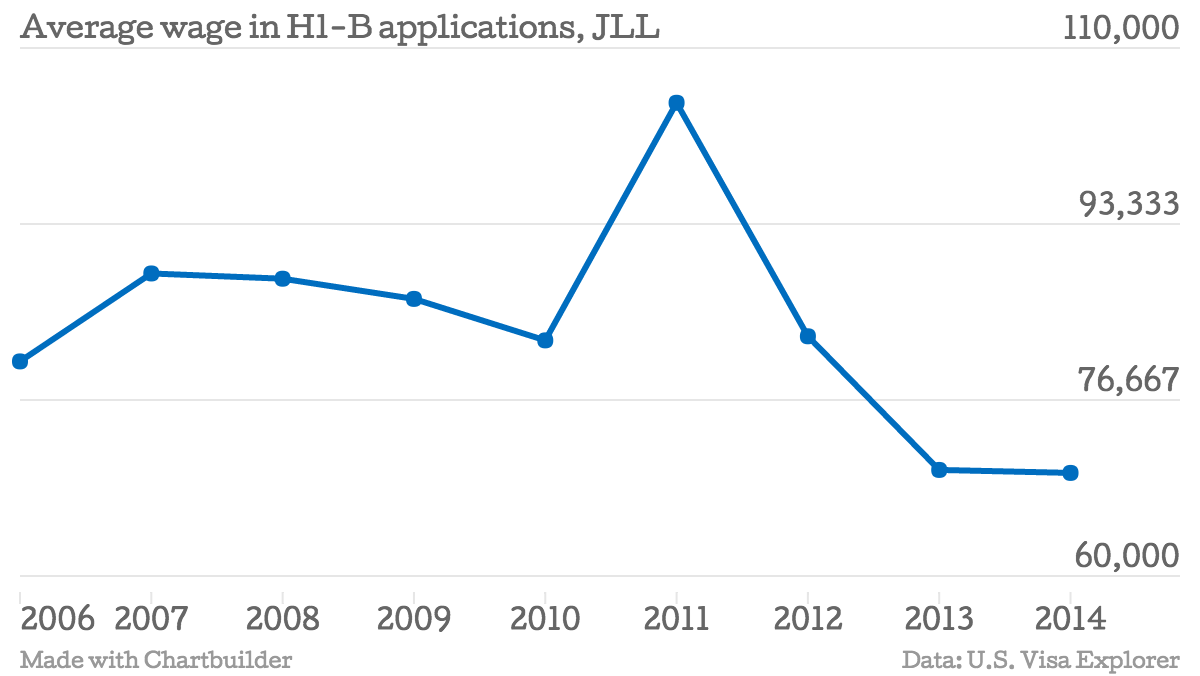

The graph above shows the average annual wage JLL wanted to pay its new foreign workers, according to the applications. JLL has been the most active H-1B applicant among the big firms, meaning its wage averages are less likely to be skewed by an individual worker.

In 2014, the average wage in 34 JLL applications was $74,652, well below the $88,649 average in 22 applications in 2007. Wages at other firms show a similar trend. CBRE’s 2014 average of $69,049 is below the $76,316 recorded in 2012, while Newmark & Company’s (now Newmark Grubb Knight Frank) 2014 average of $84,154 is only slightly above the 2007 average of $82,900.

The trend is clear: Wages for new foreign workers at major U.S. commercial real estate firms have not grown since 2007.

As noted above, this doesn’t mean wages across the industry are flat – they may have grown or fallen even more. Still, the stagnating H1-B wages in real estate are noteworthy in how they contrast with other industries – most notably technology. An analysis of U.S. Visa Explorer data by business news website Quartz found that average wages in H1-B applications by major Silicon Valley firms grew almost across the board over the past decade, and are now significantly higher than in real estate. Twitter, for example, has had an average of close to $140,000 in 2015 so far.

The take home? Real estate may be an attractive industry for skilled foreigners. But if they want to make the really big bucks, they should consider getting that computer programming degree.