As tourist season in the Hamptons was heating up last quarter, the market was slowing down, with the number of sales dropping and the median sales price declining to $849,000, compared to $908,500 during the same period last year, the latest market report by Douglas Elliman shows.

“The market has cooled from the torrid pace of a year ago,” said Jonathan Miller, president of real estate appraisal firm Miller Samuel and the report’s author.

The number of sales dropped 15.7 percent, from 700 in the second quarter of 2014 to 590 last quarter. The listing inventory was up a slight 2.9 percent, from 1,647 to 1,694.

Miller noted that last year’s market was still heavily affected by “pent up demand” created by the financial crisis. Things are different this year, he said. “We’re sort of at this middle ground… While sales are down from the record, sales are still well above average,” the analyst said.

The absorption period – the spate of time needed to sell all listed inventory – was up to 8.6 months from 7.1 months a year ago.

“The result of the combination of sales down from record levels and inventory up is that we have a slower market pace,” according to Miller.

Though the median price was down, the average was up 2.5 percent to $1,577,944, fueled by growing prices in the luxury segment of the market (defined as the top 10 percent of sales).

In luxury Hamptons sales, the average was up 6.6 percent year-over-year to $6,775,823 and the median was up 1.8 percent to $5,293,750.

The North Fork and Long Island had relatively strong quarters, which Miller attributed to a “delayed reaction” to pent up demand from the downturn.

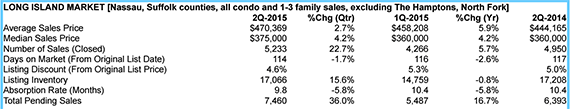

(credit: Douglas Elliman and Miller Samuel)

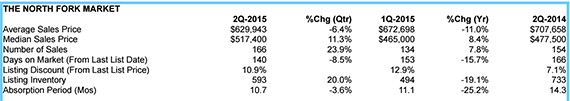

(credit: Douglas Elliman and Miller Samuel)

In Long Island, the median sales price increased 4.2 percent to $375,000, and in the North Fork, the median sales price was up 8.4 percent to $517,400. The number of sales also increased in both markets, jumping 5.7 percent in Long Island to 5,233 and increasing 7.8 percent to 166 in the North Fork.

“Long Island is doing very well,” Miller said. “It’s one of the better markets in our region right now in terms of the combination of rising prices and rising sales, and North Fork is benefiting from that.”