That “all-cash” dominated luxury condo market you keep hearing about? Turns out, it’s not really a thing.

That “all-cash” dominated luxury condo market you keep hearing about? Turns out, it’s not really a thing.

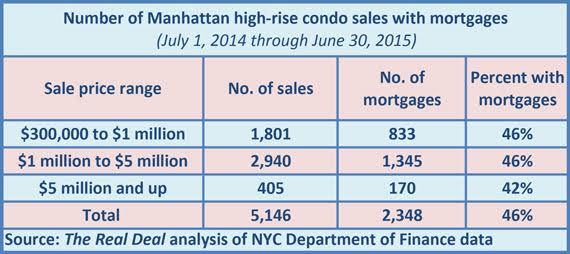

In fact, more than 40 percent of buyers purchasing Manhattan condominiums priced at $5 million or more took out mortgages, according to The Real Deal’s analysis of condo purchases between July 2014 and June 2015.

Buyers of these apartments borrowed at nearly the same rate as buyers of apartments priced between $1 million and $5 million and apartments priced between $300,000 and $1 million. The findings fly in the face of conventional broker wisdom — when TRD asked top brokers how many Manhattan luxury deals were done all-cash, estimates were as high as 85 percent.

The TRD analysis looked at 5,146 unit sales between July 1, 2014, and June 30, 2015, for condos priced at $300,000 and up. It found nearly 3,000 sales in the $1 million to $5 million range, accounting for nearly 60 percent of total transactions. The $5 million and up range accounted for 405 sales, or less than 8 percent of transactions.

The high proportion of buyers seeking mortgages across all segments of the market suggests that the pool of luxury condo buyers could be bigger than previously thought. One doesn’t need to have $100 million, or even $15 million, to afford some of these pricey pads, according to Rolan Shnayder, a mortgage banker at Citizens Bank.

“A buyer [of a $5 million condo] putting down $3.3 million would need about $3.3 million, plus about $400,000 in closing costs, plus 12 months’ worth of mortgage, taxes, insurance, and maintenance,” Shnayder said. “[Required] income depends on what other debts someone has, [on] other homes, car payments.”

“As a general rule, four times your income is the loan you would qualify for,” he added. If you are borrowing $6.7 million to buy a $10 million apartment, “you need about $1.7 million in income… a loose calculation.”

“Net worth is not that important,” said Melissa Cohn, an independent mortgage broker. “You would need $3.5 million in the bank to borrow $3 million, [plus] income of $1 million.”

To be sure, some who buy $5 million homes avoid massive mortgages because they “don’t want the hassle,” said Warburg Realty’s Jason Haber. Many of them “refinance after closing,” he added.

Some buyers “take out a small mortgage, $1 million to $2 million, to take advantage of the tax deduction,” said Leonard Steinberg of Compass.

Ed Mermelstein, a real estate lawyer, noted that wealthy individuals often finance home purchases by borrowing against their own portfolio of investments rather than against the property itself.

“The wealthier you are, the more options you have in terms of the purchase of a real estate asset,” Mermelstein said. “Investment professionals come up with some ingenious proposals on borrowing against your own assets.”’

Adam Pincus contributed reporting.