From the September issue: Multifamily investors’ hunger for elevator and walk-up buildings in Manhattan quelled over the past several months, a TRD review of city Department of Finance data revealed.

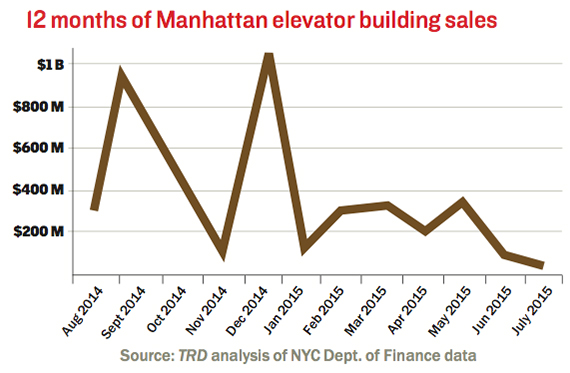

The dollar value of elevator buildings sold fell below $100 million last month, off from highs of more than $1 billion per month in September and December 2014.

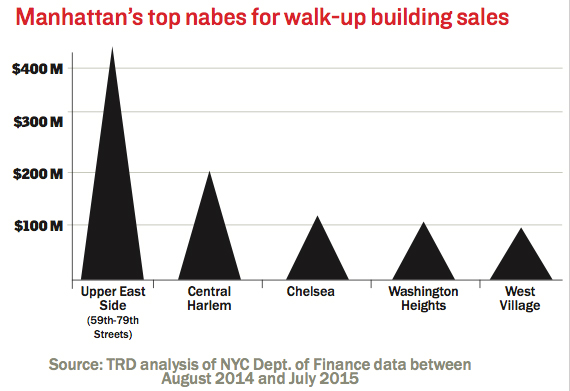

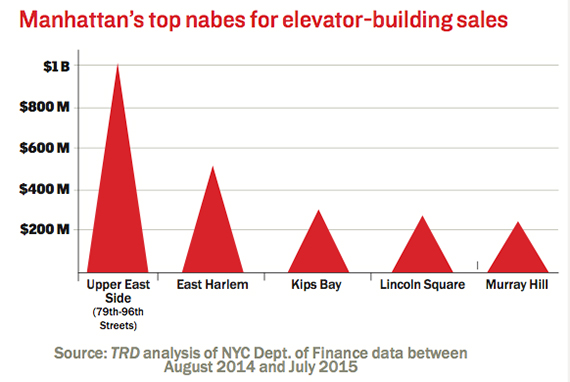

The Upper East Side was the most active area for sales in the 12 months ended July 31. For elevator buildings, sales were busiest between 79th and 96th streets. For walk-ups, it was 59th to 79th streets.

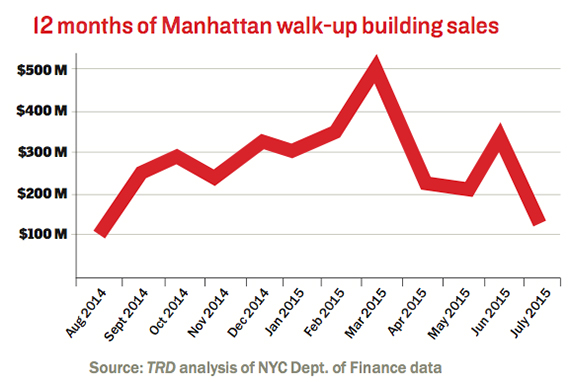

During the same 12-month period, purchases of walk-up buildings peaked in March at more than $500 million, but fell below $200 million last month.

“We definitely feel there is something going on in the market right now,” said J.D. Parker, senior vice president of investment sales at Marcus & Millichap. “There is uncertainty around the rent regulations and how that will affect multifamily investors and their business plans.”

Christopher Okada, president of Okada & Co., said some long-time walk-up investors are uncertain about yields, following the decision to give no increase for one-year leases on rent-stabilized apartments.

Investors in the model of “burn and churn, fix them up and sell them … are not even looking,” Okada said.