There aren’t many bargains in Manhattan’s red-hot condominium market, where the average sales price hit $3.4 million this spring.

But in what’s a pretty rare occurrence these days, the average price per square foot for new condo units dropped during the first half of the year, according to data provided to The Real Deal by Corcoran Sunshine Marketing Group.

The firm said the average price for properties put into contract between January and June was $2,250 per foot, down from $2,303 per foot, the average price for all of 2014.

While developers are not slashing prices for new condos across the board, the data reflects a new emphasis on mid-market or so-called “affordable luxury” projects. The average new development sold during the first half of the year was 1,481 square feet, compared with an average of 1,640 square feet for all of 2014.

“After several years with virtually no openings at these lower price points, developers recognized a real void in the market, and of course the potential for buyer demand,” said Corcoran Sunshine Marketing Group’s Kelly Kennedy Mack, who also said new development contract activity is up 42 percent since last year. Buyers signed 1,368 contracts during the first half of the year, compared with 1,856 during the first half of 2014. “Luxury projects on average have fewer units, so the introduction of large buildings at lower price points has a significant effect on the market average.”

For example, at the Related Cos.’ Carnegie Park, a 325-unit rental-to-condo conversion that launched sales in February, the average asking price is $2.4 million, or $1,676 per foot, according to StreetEasy. That compares to the $3.4 million average sale price, and $2,111 average price per foot, for new condo sales during the third quarter of the year, according to data from real estate appraisal firm Miller Samuel.

Similarly at River & Warren, a 192-unit condo conversion by developers Centurion Real Estate Partners and Five Mile Capital Partners, the average listing is asking $3.8 million or $1,934 per foot. River & Warren launched late last year.

The luxury market has also seen a dip in price per foot over the past year.

According to Olshan Realty, which tracks contracts signed above $4 million, the average asking price for in-contract units was $2,813 per foot during the third quarter, down from $2,862 per foot a year earlier.

“I think what you’re seeing is just a lot more inventory on the market, so the blended average is going down,” said Donna Olshan, founder of the eponymous brokerage.

Nearly 5,000 new condos are set to launch in 2015, up from more than 2,400 last year, according to Corcoran Sunshine. Roughly 6,200 new units are projected to come online in 2016.

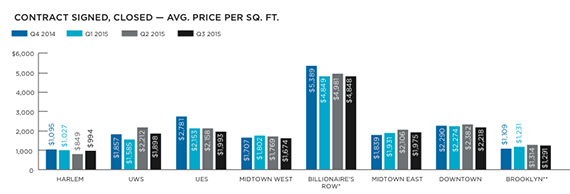

Stephen Kliegerman, president of Halstead Property Development Marketing, said there’s more inventory under $5 million than there has been in recent years. That’s why, he said, Halstead’s own data also shows a drop in price per foot in seven out of eight neighborhoods that the firm tracked.

“It’s a factor of what’s selling and what’s selling in more quantity,” he said. “We don’t see prices going down, but there’s definitely been more inventory building up in the high end of the market.”

Price per square foot on contracts signed and units closed (Credit: Halstead)

According to Halstead Property Development Marketing, the steepest drop was on the Upper West Side, where the average price per foot during the third quarter dropped by 14.2 percent to $1,898 per foot.

Kliegerman said the numbers reflect a movement toward “reasonably sized or priced apartments,” rather than the market sliding.

In the case of condos on Billionaires’ Row, he added, the average price is particularly susceptible to being skewed by high-priced closings. And while units are closing at Extell Development’s One57, they haven’t yet begun at Vornado Realty Trust’s 220 Central Park South, Macklowe Properties’ 432 Park Avenue or Zeckendorf Development’s 520 Park Avenue. “So you probably have a little bit of a lack of depth of units to establish a trend,” he said.