Even after a summer of sluggish sales, the Hamptons market is getting pricier.

Homes under $1 million in the tony beach community now account for just under 50 percent of the market, the lowest point in four years, according to the latest quarterly report from Douglas Elliman and appraisal firm Miller Samuel.

Homes over $5 million, meanwhile, now account for a larger piece of the pie at 44.4 percent, up nearly nine percent from last year.

But unlike last year’s frenzied summer sales season, buyers during this year’s third quarter didn’t rush to sign on the dotted line. Across the board, the number of sales during the third quarter plummeted 20 percent to just 507, according to the report, while inventory levels held steady compared to last year, with around 1,700 properties for sale.

Jonathan Miller, president of Miller Samuel and author of the report, said there were fewer sales because the market was returning to normal after the frenzy in 2013 and 2014, which reflected pent-up demand from the financial crisis. “In 2013 and 2014, we had record sales,” he said. “We’re coming down off that sugar high.”

Despite the slow pace of sales, the median sales price jumped 9.8 percent to $950,000, and the average sales price remained relatively unchanged at $1.7 million, according to the report.

Miller said the lower end of the market drove the overall price growth, said Miller. The median price for home sales under $1 million rose 10.2 percent to $567,000. By contrast, the median price for homes between $1 million and $5 million only increased 1.3 percent to $1.9 million. “

During the third quarter, there were just 31 sales of homes $5 million and up, the lowest number in two years.

(Credit: Douglas Elliman/Miller Samuel)

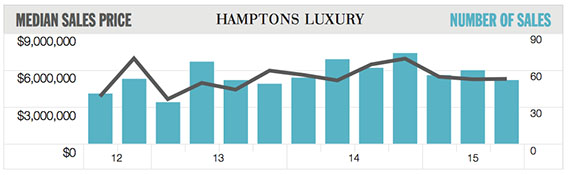

The entry threshold for the luxury market also dropped nearly 4 percent to $3.7 million. And the median sales price in the luxury market – defined as the top 10 percent of sales – plummeted 18 percent to $5.3 million, while the average sales price dropped 15 percent to $7.1 million.

With prices softening, inventory also piled up. There were 292 homes for sale during the third quarter, a nearly 34 percent jump from last year.