New building permit filings tumbled in November, with only 1,843 apartment units applied for across the city, according to a new analysis by The Real Deal. November’s numbers were the lowest on the year since April, when qualifying units dipped well below 1,000.

TRD looked at Department of Buildings permit data for all proposed projects of at least 15,000 square feet. Despite a relative drought across the boroughs, the first major multifamily project in East New York in over a year hit DOB records. Phase II of the Livonia Commons affordable housing complex will bring four buildings to the intersection of Livonia Avenue and Hinsdale Street (Phase 1 is nearing the end of construction and will hold 278 units).

The day after those plans were filed, Community Board 5 rejected Mayor Bill de Blasio’s proposal to rezone a northern section of East New York for higher density and market-rate development with a resounding 0-17 yea-to-nay vote, with many fearing that an influx of mostly market-rate rentals would lead to the displacement of longtime residents. A fortnight later, New York City Comptroller Scott Stringer released an analysis stating that 50,000 East New York residents would be at risk of displacement if the mayor’s plan were implemented. Furthermore, the “affordable” units would likely be unaffordable for 55 percent of current residents, Stringer said, and the market-rate rent for two-bedroom units would be unaffordable for 84 percent of current residents. (De Blasio, as expected, disputed Stringer’s findings.)

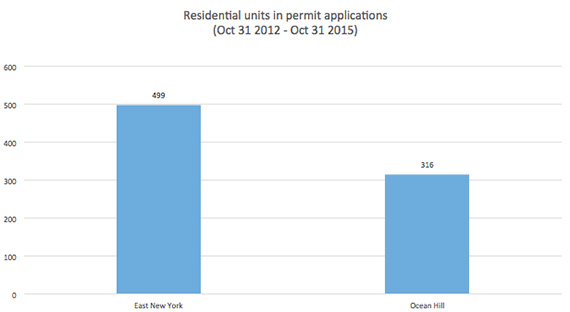

The full rezoning proposal also includes the northern section of Ocean Hill (sometimes considered a subsection of Bedford-Stuyvesant) and part of Cypress Hills (which is a subsection of East New York). A look at permits from the last three years shows that before November of this year, just over 800 new units had been planned for those neighborhoods, which together constitute more than two square miles, and most of those units are known to either be NYCHA housing or other publicly funded rental apartments. Additionally, most of those projects were planned for outside of the proposed rezoning area.

Source: TRD analysis DOB permit applications of at least 15,000 square feet. East New York includes Cypress Hills.

In February, when the de Blasio administration debuted the East New York zoning proposal, the city projected that if no action were taken, the proposal area would only witness the construction of 550 new dwelling units between 2015 and 2030. If the rezoning plan were implemented, the administration contended, nearly 7,000 more units could rise (in the updated September community plan “over 6,300 units” is referenced). The mayor has also argued that private developers will eventually start building more market-rate housing in East New York, with or without new regulations—but they aren’t doing it yet.

In the market-rate realm, there were a few significant permits filed in November, mostly in Manhattan. AvalonBay Communities, for example, is looking to build a 416-foot mixed-use tower at the site of the former American Bible Society headquarters at 1865 Broadway. The Lincoln Square project will include 160 residential units.

The project with the most units was once again in the Bronx, however, where Monadnock Development applied to build one of the Compass Residences buildings, which will include 185 units at 1905 West Farms Road. The full 10-building development is considered to be the largest in Bronx history, and will eventually include 1,300 affordable apartments. Toll Brothers contributed the fourth largest application of the month, with a 133-condo high-rise in Gramercy at 122 East 23rd Street.

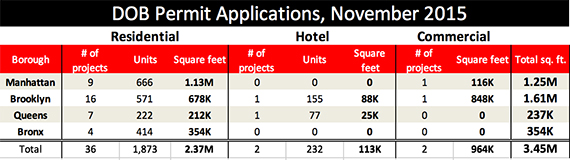

Manhattan led all boroughs in residential permits by qualifying units (666) and square feet (1.13M) in November. Brooklyn, again, had the most qualifying projects (16).

Source: TRD analysis of DOB permit applications of at least 15,000 square feet.

Both qualifying hotels filed in November were in the outer boroughs. Pearl Realty is looking to construct a 155-key hotel in Greenpoint at 60 West Street. In Queens, developer Wil Ni is looking build a 77-key Hotel Across The Street from a scaffolding supplier in where else but Long Island City at 37-17 12th Street.

Commercial filings on the month went a bit beyond the usual storage facilities and bodega renovations. Boston Properties and Rudin Management put in their permits for Dock 72, a 556,000-square-foot office building at the Brooklyn Navy Yard which will be anchored by WeWork. In Manhattan, Aurora Capital and William Gottlieb Real Estate applied to build a 116,000-square-foot office and retail building in the Meatpacking District at 40 10th Avenue, after struggling through ardent community opposition to plans. The second largest commercial filing of the month, however, was indeed a 157,000-square-foot storage facility, on behalf of Storage Deluxe at 3024 Cropsey Avenue in Coney Island.