In a huge win for real estate developers, Congress extended the popular, controversial and widely-debated EB-5 visa program for another year with no changes. Not a one.

The program, which gives foreign investors a green card in exchange for a $500,000 investment in the U.S. economy, was part of the omnibus spending bill passed by Congress late Tuesday.

In the months leading up to the vote, lawmakers weighed several changes to the EB-5 program, including a higher investment threshold and stricter oversight. But after politicians failed to agree on a compromise bill, the program was extended through Sept. 30, 2016.

The vote is a coup for New York developers, who have raised more than $3.7 billion from EB-5 investors, a vast majority of them Chinese, according to an analysis this year by The Real Deal. “It will be very interesting to see the market reaction, especially in China,” Ronald Fieldstone, a lawyer at Arnstein & Lehr LLP, wrote in a blog post Wednesday. “Probably a great sigh of relief.”

Several of the proposed changes, however, stem from criticism that EB-5 lacks oversight and is rife with fraud.

From left: Sen. Dianne Feinstein and Sen. Chuck Grassley

In November, Sen. Dianne Feinstein, one of the Senate’s most senior Democrats, called for an end to the program altogether on the grounds that it “sends a message that American citizenship is for sale.” Sen. Charles Grassley, the Iowa Republican who chairs the Senate Judiciary Committee, has lambasted New York developers for co-opting the program to build glitzy condos instead of funding projects in rural areas with low unemployment.

Though most New York builders are gung-ho about the program, it does have some big-name detractors in the development community. Eliot Spitzer, former governor of New York and now an active developer, said the program rubs him “the wrong way.” Champions of the program include Steve Witkoff, who is raising $220 million from EB-5 investors for his 1 Park Lane development, as well as Related Companies, which raised more than $600 million from EB-5 investors for its Hudson yards development.

Over the past few months, developers lobbied to keep certain provisions in place. Related spent $730,000 on lobbying efforts, according to data from OpenSecrets.org, which tracks lobbying expenses. Silverstein Properties, which is raising $500 million for 2 World Trade Center, spent $20,000.

Most in the industry believed that EB-5 would be extended, but predicted that it would come with a few key changes, including an increase of the minimum threshold for investment and a change to the rules about where development projects could be built. At the eleventh hour, however, several proposed changes derailed consensus among lawmakers who were voting to renew the program.

“The industry groups said [the proposals] would kill the program and in the end, Congress decided they didn’t want to rush,” said Ron Klasko, managing partner at Philadelphia-based Klasko Immigration Law Partners.

Here’s a rundown of the issues that tied up EB-5 for another year.

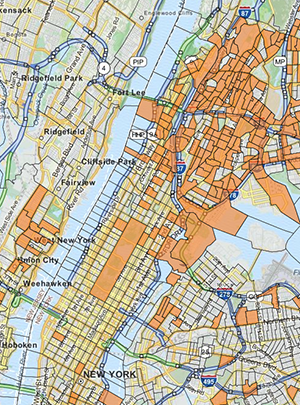

New York City map with TEAs shown in orange (Credit: EB5 Affiliate Network)

1. Targeted employment area

The definition of TEAs – low-income neighborhoods where investors only have to spend $500,000 (instead of $1 million) – is one of the most contentious parts of the EB-5 program. New York developers historically benefited from TEAs by drawing special districts to link their glitzy condo projects with poor areas, a practice critics say is gerrymandering. A proposal would have restricted the definition of TEAs.

Developers – and their supporters – say their projects qualify as TEAs since they hire workers from low-income areas. The proposed restriction would have eliminated most projects in New York, said Klasko.

2. “Reserved” visas

Introduced last week, the proposal would reserve 6,000 visas – out of a total of 10,000 awarded each year – for investment in three categories. The categories included rural areas, urban impoverished areas and areas outside of TEAs.

But critics said the system would leave just 4,000 visas for projects outside those categories, leading to a 10- or 15-year waiting list for EB-5 investors. “It would have killed the program, a lot of us felt,” Klasko said.

3. Limits on indirect jobs created

In an effort to ensure the EB-5 program creates jobs, the measure would require 10 percent of the new jobs created to be directly tied to a specific project.

But critics said there was not a clear way to calculate direct versus indirect jobs. And it was possible that condo projects, where construction could last two years, would not meet the proposed standard.

4. Foreign agents

With the goal of having better oversight of the foreign agents who bring investors to developers, a proposal would have established qualifications for those agents and set standards for the fees they charge.

But critics questioned whether it was the place of the U.S. government to tell foreign agents how much they can charge.