The Federal Reserve has finally lifted interest rates from 0% and after nine years without a rate hike.

The potential ramifications of the policy move are far-reaching and span various American industries, from automakers to homebuilders to investment banks.

But those impacts may be disparate.

Typically, rising interest rates make for a more difficult borrowing environment. That has the potential to slow home sales, which impacts US banks, as well as new starts, which will hurt homebuilders.

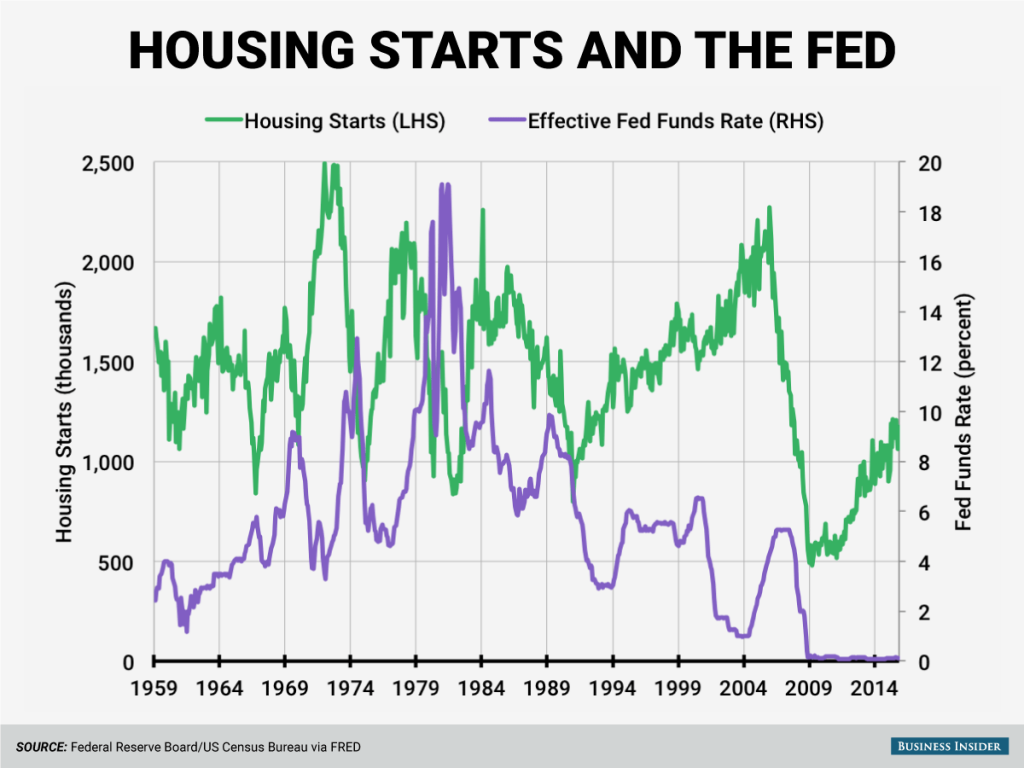

With the Fed’s rate hike, history shows homes starts have tended toward a decline, which will inevitably hurt homebuilders. When rates get higher, building new homes is usually a less attractive prospect.

“Homebuilding stocks are typically losers from an absolute and relative standpoint during tightening cycles,” according to a separate Credit Suisse note from December 15. “Historically homebuilding stocks underperformed the S&P 500 during each of the past six Fed tightening cycles.”

For years after the Federal Reserve’s decision to back down interest rates to 0%, a badly beaten homebuilding sector saw gradual increases in both homes starts and permits. They never rose to the pre-crisis levels, but the period that led up to this was in part fueled by an unprecedented boom in lending to many unqualified borrowers.

Yet it is debatable on Wall Street whether the average consumer’s psyche is far less tethered to the behavior of US central bankers than, say, that of a Wall Street executive.

“If we do see some rate increases coming, because it reflects a stronger economy, nobody is going to not buy a house because the mortgage rates went up,” Wells Fargo CEO John Stumpf said the Goldman Sachs Financial Services Conference earlier this month. “They can choose a different product and probably get the same rate. The same thing is true for small businesses.”

But Bank of America CEO Brian Moynihan doesn’t agree with Stumpf.

“If you see rates rise, you’ll see the mortgage market slow down,” Moynihan said at same event earlier this month, before the Federal Reserve raised rates.

At still the same event, Blackstone Group CEO Steve Schwarzman noted that most interest-rate hikes have typically resulted in an uptick in home prices.

“Twenty-five out of 26 times when interest rates went up, home prices went up,” Schwarzman said.

If that is indeed the case, homebuilders may be better building more and aiming to make it up on margin. Even at the end of 2016, interest rates are expected to remain near record lows for the last half-century.