UPDATED: 3:25 p.m., Jan 20. 2016: Related Companies and Oxford Properties saw 10 Hudson Yards’ “market value” – assessed for tax purposes – grow by nearly $250 million year-over-year according to city assessments released Friday, the largest increase of any property in the city.

The city valued the property at $332.8 million, up from $84 million the previous year.

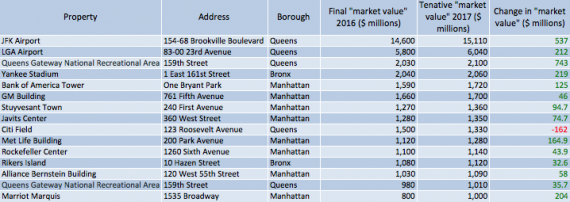

Vornado Realty Trust’s 1.8 million-square-foot hotel and retail building at 1535 Broadway saw its city-assessed market value climb by just over $200 million, to just over $1 billion.

In total, 15 city properties crossed the $1 billion threshold this year, including the Bank of America Tower at One Bryant Park; Boston Properties, Safra Group and Zhang Xin’s GM Building; and Stuyvesant Town, recently purchased for $5.3 billion by the Blackstone Group and Ivanhoe Cambridge, along with city landmarks like John F. Kennedy and LaGuardia airports, Yankee Stadium and Citi Field.

Tentative 2017 “market value” assessments based on data from FY 2015

The city’s figures – despite measuring what’s known as “market value” – are not in fact meant to estimate the price of properties were they to be sold on the market.

For commercial properties, the estimates are often as little as 50 percent or less of the true market value. In addition, these figures are based on income and expense figures filed with the city for the calendar year 2014, so the values lag the current market by a few years.

As an example, the assessed “market value” of the GM Building – which was valued at $3.4 billion when Zhang Xin and Safra bought their stakes – was pegged by the city at $1.7 billion.

All together, the city valued New York real estate at just over $1 trillion, a 10.6 percent increase from the previous year.

Correction: A previous version of this article identified 1375 Broadway as the Vornado property whose assessed market value grew by over $200 million. It was actually 1535 Broadway.