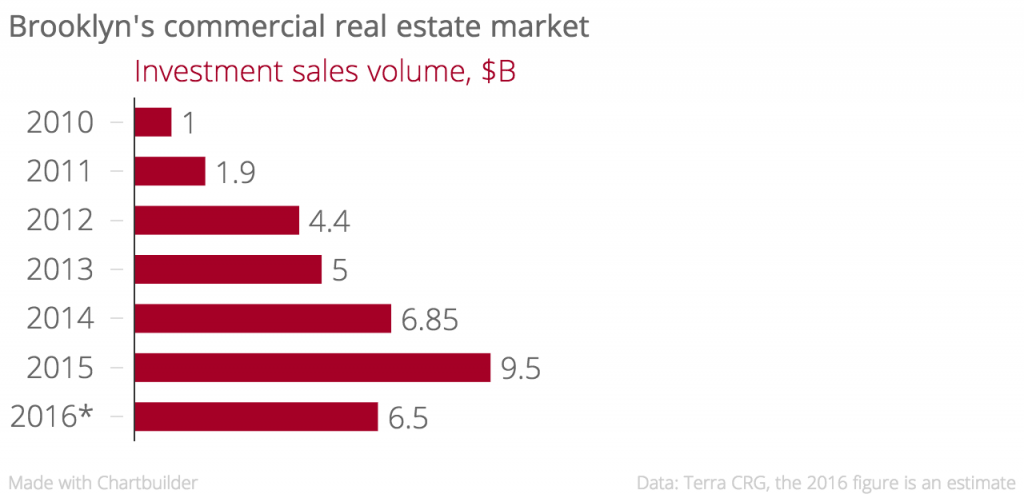

Brooklyn’s commercial real estate market had a record year in 2015, but 2016 is looking a lot less rosy. Sales volume is likely to take a big dip this year, according to a new report by brokerage TerraCRG.

The firm estimates that the dollar value of commercial sales (including office, industrial, multifamily buildings and development sites) could shrink by about a third, from a record $9.5 billion in 2015 to between $6 and $7 billion. It also expects that average sales prices will stay flat.

If the predictions are correct, that would still make 2016 a very good year by historical standards (see chart), and TerraCRG does not expect a market crash. But it would also mean that the days of breakneck growth are over. The firm’s founder and president Ofer Cohen said it is unlikely that Brooklyn’s market will have another year like 2015 anytime soon.

Driving the expected dip is a sharp decline in the number of development sites sold, TerraCRG reckons. Sales of existing buildings, in contrast, could still remain strong. The brokerage expects new development deals to fall from more than $2 billion to less than $700 million. “We’re not going to see massive rental development sites trading,” Cohen said at a media briefing at TerraCRG’s office Wednesday morning.

There are two main drags on new development in Brooklyn: uncertainty over the 421a tax abatement, which expired last week, and the unusually large volume of new multifamily supply set to hit the market in the coming years.

Rental buildings account for the vast majority of residential development in Brooklyn, and these projects have long relied on the 421a tax abatement to make the numbers work. But the abatement, which slashes property taxes in return for affordability concessions, has seen months of uncertainty as politicians, industry leaders and labor groups debated its future. Last week, the program expired. Without the incentive, many developers could find rental construction to be unprofitable – at least at current land prices – and hold off on site purchases.

Without the abatement, more developers could switch to condo construction, but condos account for a mere 10 percent of new development and are unlikely to have a big impact overall.

And the uncertainty over 421a comes at the exact time as developers are already starting to worry that the enormous volume of new supply set to hit the market in the coming years could drag down rents.