Manhattan and Brooklyn residential prices reached record highs in 2015, but buyers and sellers can expect lower price growth this year, according to new projections from StreetEasy.

In Manhattan, the median resale price is projected to grow just 0.8 percent to $1.01 million, according to the listing portal’s fourth-quarter market report, released today. That’s way down from the 7.1 percent growth experienced between 2014 and 2015.

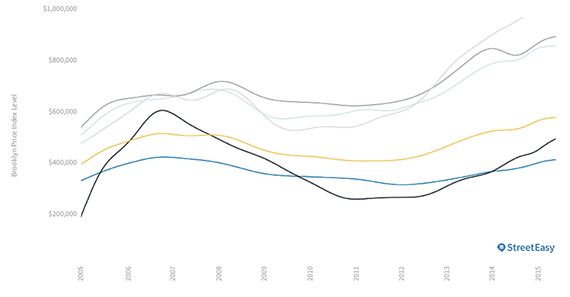

In Brooklyn, the median resale price is forecasted to grow 4.2 percent to $560,005, compared with the 8.3 percent growth to $537,193 in 2015.

“The spike in global and investor demand in 2014 appears to have been fully served,” according to report.

Overall, Manhattan and Brooklyn prices reached record highs during the fourth quarter of 2015, although inventory dipped in both boroughs.

In Manhattan, where the median price topped $1 million for the first time during the fourth quarter, the highest price growth was in Upper Manhattan, where the median resale price shot up 14.6 percent to $641,882.

But the number of Manhattan properties for sale during the fourth quarter dropped 3.5 percent to 10,122 – the lowest since StreetEasy began tracking data. Midtown was an outlier, according to the report, with 2.7 percent inventory growth.

Brooklyn’s median resale price grew 8.3 percent, according to StreetEasy, which said the highest price growth occurred in East Brooklyn – which includes Bedford-Stuyvesant, East New York and Crown Heights – where median resale prices reached $464,285, an 18.1 percent jump from 2014’s fourth quarter.

In Brooklyn, inventory reached 4,746 – roughly half the size of Manhattan’s market, and about 1.5 percent higher than 2014’s fourth quarter.

(Credit: StreetEasy)

With fewer Manhattan apartments on the market, StreetEasy noted the pace of sales picked up and the average number of days homes spent on the market declined by three days to 51 days. In Brooklyn, the market was less competitive, however: The pace of sales was roughly the same, with homes spending 48 days on the market. Discounts were also more widespread, with 25.7 percent of homes experiencing discounts, and the typical price cut rising marginally to 6.1 percent.

In both boroughs, the median rent continued to climb. Manhattan’s median rent was $3,112 during the fourth quarter, a 4.7 percent increase from a year earlier. Brooklyn’s median rent crept up by 2.1 percent to $2,630. The highest growth was in Prospect Park, where median rent was $2,815 during the fourth quarter, a 4.7 percent increase from the prior year.