Since the city announced a rent freeze for stabilized apartments in June, investors have increasingly shied away from rent-regulated buildings. But not Stonehenge Partners CEO Ofer Yardeni.

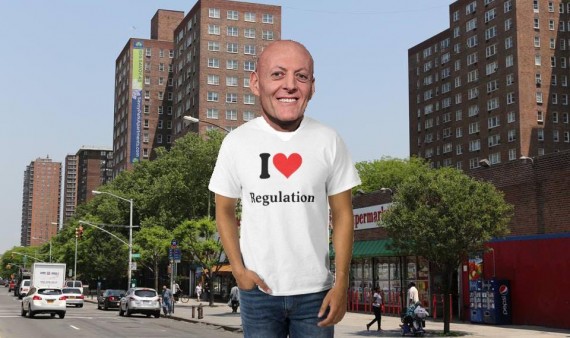

“I like rent-stabilized [units]. I love regulation. The more regulation, the better,” Yardeni said at an Ariel Property Advisors panel Thursday. “If I go to sleep, I say ‘de Blasio, give me regulation.’”

In June, the Rent Guidelines Board voted to freeze rents at the city’s 1 million stabilized apartments for the first time ever, dealing a blow to landlords’ bottom line. As a result, many investors have grown cool on stabilized properties. In November, Shaun Riney, a broker in Marcus & Millichap’s Brooklyn office, told The Real Deal that these properties “used to be attractive because you had upside, but rents are frozen and there’s an amount of risk that was never before the case.”

Yardeni takes issue with that logic. The head of Stonehenge Partners claims that when it comes to regulated buildings, he makes most of his money through deregulating units, meaning the freeze has little negative impact for him. On the contrary, by scaring off other potential investors, the rent freeze actually makes it easier for him to buy stabilized properties at a decent price, Yardeni argued.

“Regulation is fantastic for my business,” he said, adding that he would have “no issue” with stabilized rents staying flat over the next five years.

In December, Stonehenge paid $135 million for a rental building at 210 West 70 Street with some rent-stabilized units. On Thursday, Yardeni disclosed that Canadian investment firm Ivanhoe Cambridge is its partner on the deal.

Yardeni shared the stage with moderator and Ariel Property Advisors president Shimon Shkury, Slate Property Group’s Martin Nussbaum and Fairstead Capital’s Will Blodgett. The latter agreed with him.

“I think that people right now are really afraid of rent-stabilized [units],” Blodgett said, “and there’s going to be real opportunity there to purchase at prices that are somewhat rational.”