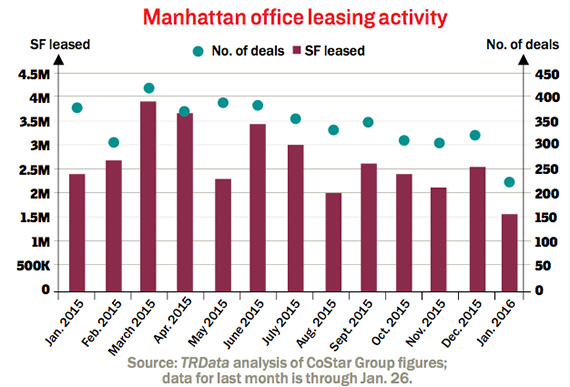

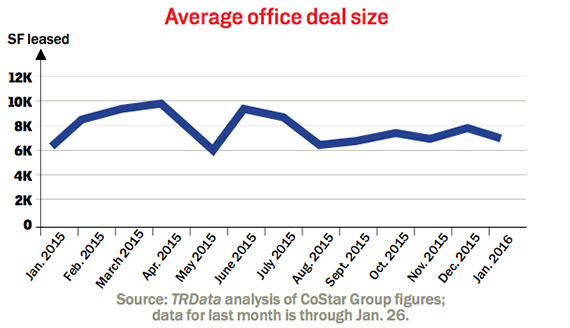

From the February issue: Manhattan office and retail leasing got off to a tepid start in 2016, and brokers are now increasingly nervous about what’s ahead. Those nerves stem largely from global and political uncertainties that are making tenants cautious. Both office and retail leasing volume were down last month compared to the month-over-month and year-over- year figures. Office leasing activity was down about 1 million square feet from both December and January 2015.

“Things are slow and getting a little slower, until stuff sorts out,” said Joseph Thanhauser, chairman of the Manhattan- based Byrnam Wood. “There seems to be an increasing reluctance to make big commitments now in the presence of so much uncertainty.”

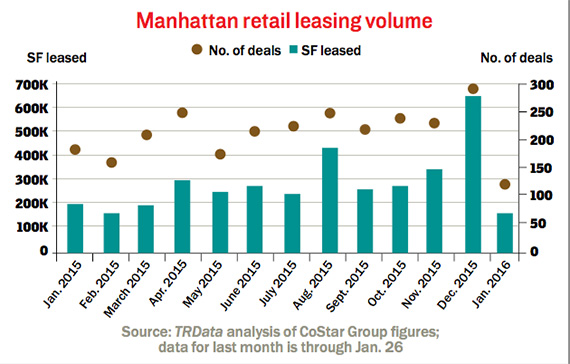

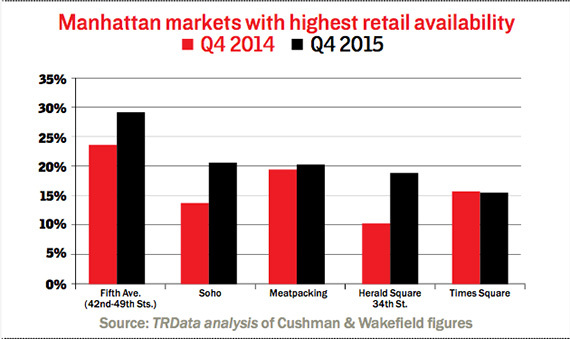

Meanwhile, insiders are expecting a more modest retail market this year, with some predicting a drop in tourism and others noting that tenants are jittery over high rents. Manhattan retail leasing ended 2015 on a high note, even as availability rates crept up. But January’s preliminary figures show a reversal of that leasing rush. The five submarkets with the highest availability saw their figures rise or stay at. Much of that, however, is at spaces where landlords are seeking higher rents. “They have the right to ask for increases in rents. And sometimes the tenants push back,” said Soozan Baxter, an independent retail advisor.