It’s not unusual for a Brooklynite to receive a letter entreating them to sell their home or property, but a recent missive from an affiliate of Silvershore Properties struck a nerve with one Williamsburg townhouse owner.

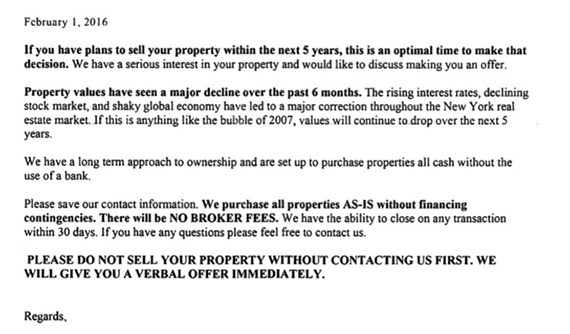

The letter claims that property values have seen a “major decline” over the past six months, and urged the homeowners to sell. Factors such as rising interest rates, a declining stock market and a shaky global economy, has led to major correction in the real estate market, according to the letter.

Brownstoner reported that a reader, who was not named, was incensed to receive a letter that he said contained “flat out lies.”

Dolphin Equities, an entity affiliated with Silvershore Properties, sent the letter, Jason Silverstein, a principal with Silvershore, told The Real Deal.

“I don’t think what we sent in the letter was off base,” he said.

The letter stated that property values have seen a “major decline” over the past six months.

“If this is anything like the bubble of 2007, values will continue to drop over the next five years,” the letter stated.

(credit: Brownstoner)

Median residential resale prices in Brooklyn are forecasted this year to grow 4.2 percent to $560,005, according to recent projections from StreetEasy. In 2015, there was 8.3 percent growth to $537,193.

Silverstein said the firm wasn’t trying to dupe anyone into selling their property. The point of the letters, he said, is to acquire property.

The Williamsburg owner told Brownstoner the firm’s tactics are deceptive and unfair.

“Unlike the solicitations I’ve seen in the past there are flat out lies in here designed to scare owners who don’t know any better,” he told Brownstoner.

A Brownstoner reader told the website, “It makes my blood boil,” regarding the letter.

Silvershore Properties was founded in 2008 by Silverstein and David Shorenstein, both former Marcus & Millichap brokers. In July last year, Related Companies bought a portfolio of 10 walk-up residential buildings in Brooklyn and Queens from Silvershore for $39.4 million, as TRD reported.