In a town where buyers pay a premium for privacy, the U.S. Treasury’s plan to start tracing anonymous purchases of Manhattan real estate begged an immediate question: Would buyers tap the brakes?

Nearly a month into life with the so-called “LLC disclosure rule,” the answer is a resounding no.

“It hasn’t made a difference,” said CORE’s Emily Beare, who sells high-end condominium units and pointed out several legitimate reasons for buying an apartment anonymously or through LLC, including tax and estate planning purposes. “Some want to protect their privacy from the public. … It’s not to hide anything.”

In January, Treasury officials said they would start tracking luxury all-cash property deals made through shell companies and LLCs in an attempt to root out “dirty money” being laundered through New York City real estate. The rule, which covers sales above $3 million, took effect March and runs through August.

The rule places the burden of disclosure on title companies – the subject of a recent investigation by The Real Deal. But it’s been criticized for its many loopholes, including the exclusion of wire transfers, which are commonly used in “cash deals” above $3 million.

“That rule is being discussed more than the discussion of where do I sign to buy an apartment in the $20 million and over range,” said Brown Harris Stevens’ S. Jean Meisel. “The interesting thing is that it is being discussed by American citizens whose funds have been legally earned and taxed, but who prefer to keep their wealth a matter of privacy and confidentiality.”

Kathy Braddock, co-managing director of William Raveis NYC, said despite buzz around the rule, she has not seen meaningful results. “I think we need to see what happens in the next six months,” she added, referring to the March-to-August timetable for the rule.

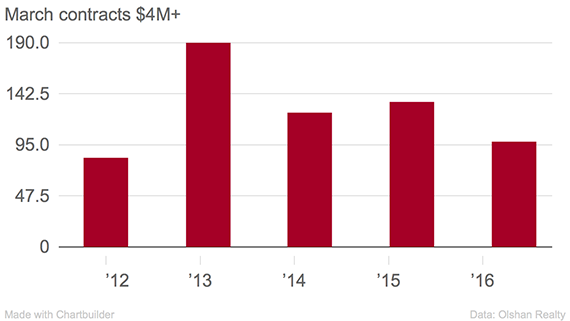

Still, there were fewer contracts signed on properties $4 million and up compared to this time last year, according to data compiled by Olshan Realty at TRD’s request. There were 98 contracts signed at $4 million in March 2016, compared with 135 in March 2015.

Contract activity March 2012-2015

Douglas Elliman’s Frances Katzen said while she hasn’t personally seen a drop-off in sales, several high-end clients have expressed concern about the rule.

“The question is privacy,” she said, referring to speculation that personal information collected by the Treasury could end somehow end up in the public domain. Katzen predicted that buyers who are very concerned about their privacy would learn how to avoid the rule.

“At the end of the day, it doesn’t preclude people from buying,” she said, but “the high net worth culture in this town doesn’t want Mr. and Mrs. Jones Googling their address to find out where they live and what they paid.”