It sure was fun for developers while it lasted. But those now bringing new product to Manhattan have more tempered expectations.

The overall projected sellout (aggregate offering price) of Manhattan condominiums approved for sale fell significantly in the first quarter of 2016, a TRData analysis of new offering plans found. The projected total sellout for these projects was $2.8 billion, a 44 percent year-over-year drop from $5 billion in the first quarter of 2015.

Last year’s first quarter figure was anchored by the $3 billion sellout for Vornado Realty Trust’s 220 Central Park South, the Robert A.M. Stern designed tower which Vornado is reportedly spending $5,000 per foot to build. The priciest plan accepted so far in 2016 is Related Companies’ 47-unit 70 Vestry Street, a Tribeca project with a total asking price just shy of $700 million.

The drop in total offering price in the fourth quarter of this year also came on the heels of the highest ever dollar volume of accepted plans in a single quarter, $8.2 billion in the fourth quarter of 2015. Plans accepted in that period include Chetrit Group’s 550 Madison Avenue ($1.9 billion) Extell Development’s One Manhattan Square ($1.87 billion), and JDS Development Group and Property Markets Group’s 111 West 57th Street ($1.45 billion).

But while the total price of accepted condo plans fell substantially last quarter, the number of units that will be added to the sales pipeline is only down slightly, the analysis found. In the first quarter of 2016, 839 residential units were included in 20 approved condominium plans, a 3.5 percent year-over-year drop from 869 across 16 projects.

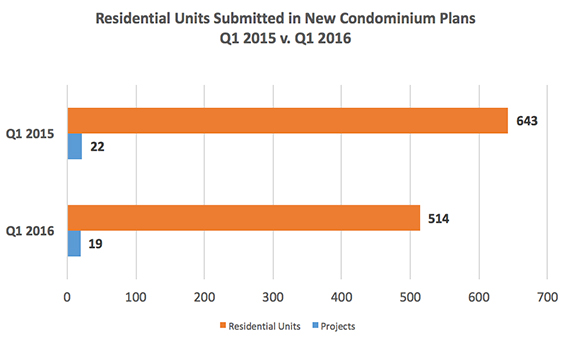

Looking at the number of proposed units in new plans still awaiting approval, however, a different picture emerges. There were a total of 514 residential units in new plans submitted to the New York Attorney General’s office in the first quarter of 2016, a 20 percent drop year-over-year from 643.

Source: TRD analysis of new offering plans submitted to the NY State AG

Last year saw the most new condo unit submissions of any year since before the financial crisis of 2008, as TRD recently reported. This year, however, Manhattan has so far failed to keep pace, and it appears as if the top of the market is seeing the biggest changes. Developers of luxury condos have been slashing the asking prices of their penthouses, for example, with nearly a third of such units currently on the market seeing a price cut at some point during their listing period. And some of what’s currently available in the $5 to $10 million market has been labeled “dead wood” by critics.

To see a quarterly breakdown of condos by total offering price, visit TRData.