Trending

Average effective Manhattan office rents grew 3% in Q1, but there are signs of wariness

Landlord concessions remain on the rise: CompStak

Despite waning optimism in some sectors of the Manhattan commercial real estate market, the first quarter of 2016 saw strength in both office leasing volume and effective rents – albeit with a continued rise in landlord concessions, according to real estate research firm CompStak.

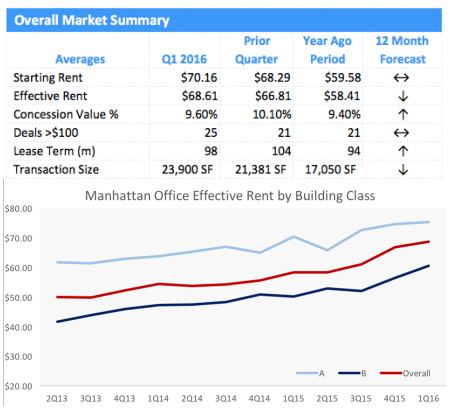

The average effective rent in Manhattan – the rent paid when adjusted for concessions like free rent and tenant improvements – grew 3 percent quarter-over-quarter through the first three months of this year to $68.61 per square foot, per CompStak data provided to The Real Deal.

That number was up more than 17 percent from $58.41 per square foot in first quarter of last year, though CompStak’s 12-month forecast predicts a decline in effective rents that would mirror growing wariness about the Manhattan office market’s prospects.

The first quarter of 2016 also saw concession values continue to increase, which is “a sign of market weakness as landlords give bigger incentives to lure tenants,” per CompStak.

Having been “relatively flat” in the two years leading to 2015, concessions have increased over the past year to average “around 10 percent of the value of the lease” — a trend that could indicate “where the market is heading in 2016.”

Leasing volume in Manhattan remained strong in the first quarter, however, and was 8 percent above average compared to the 12 previous quarters. There were 25 leasing deals struck over $100 per square foot in the period, up from 21 such deals in both the previous quarter and year-earlier period.

CompStak also noted a “rent growth surge” in Class B office buildings, as “landlord investment in renovations coupled with demand for cheaper space” helped drive Class B rents 10 percent above the prior two quarters.

The “darling” Midtown South office market, meanwhile, cooled down somewhat – with average effective rents unchanged at just under $67 per square foot in the first quarter. While effective rents in Midtown South grew 15 percent over 2015, CompStak said only “a few select high profile deals” – like Facebook’s 80,000-square-foot expansion at Vornado Realty Trust’s 770 Broadway – spared the submarket from “a meaningful drop in average effective rents” through the first three months of the year.

Midtown effective rents grew 6 percent from the previous quarter, to $74.51 per square foot. Financial, insurance and real estate (FIRE) tenants represented 16 of the 20 biggest office deals signed in Midtown, while effective rents for Class A buildings in the submarket rose above $80 per square foot “for the first time.”

Effective rents in Downtown were up 3 percent from the previous quarter to surpass $51 per square foot — marking “nine straight quarters” of rent growth in the Lower Manhattan office submarket. CompStak noted that technology, advertising, media and information (TAMI) tenants have continued to migrate Downtown, turning it into a “hotbed” for the city’s growing tech and creative industry companies and making it likely that “Downtown rents will continue their nine-quarter rally through 2016.”