Sovereign wealth funds’ growth slowed over the past year amid falling oil and commodity prices. The trend could impact New York’s commercial real estate market, where funds like Norges Bank and the Abu Dhabi Investment Authority are among the most active investors.

Total assets under management across all sovereign wealth funds grew by around 3 percent, or $200 billion, between March 2015 and March 2016, to $6.51 trillion, according to a new report by research firm Preqin. This marks a considerable slowdown compared to the previous three years, when annual growth averaged around 16 percent.

Non-commodity sovereign wealth funds did well, increasing their assets by a combined $230 billion. But oil funds saw their assets dip by a combined $10 billion and some other commodity-based funds shrank by as much as half, according to Preqin.

Oil and commodity prices are down sharply over the past year, causing some anxiety that commodity-rich countries could be forced to dial down their investment in New York commercial real estate.

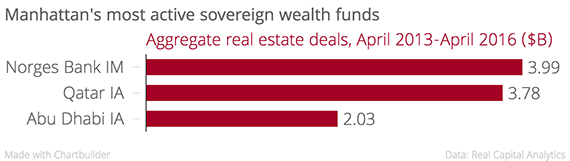

Oil-producing countries accounted for 15 percent of foreign investment in New York over the past year, but their sovereign wealth funds were behind several high profile deals. Qatar Investment Authority, for example, recently bought a 44 percent stake of Brookfield Properties’ $8.6 billion mixed-use project Manhattan West while the Abu Dhabi Investment Authority bought two Manhattan hotels for more than $700 million in 2015.

But it’s not all bad news for New York real estate. While asset growth slowed over the past year, the share of sovereign wealth funds that invest in properties ticked up from 59 to 62 percent. And Norway’s Norges Bank, the sovereign wealth fund most active in Manhattan’s real estate market according to Real Capital Analytics (see chart above), saw its assets under management grow from $818 billion to $835 billion. The fund recently bought a 44-percent stake in Trinity Real Estate’s 5-million-square-foot New York real estate portfolio for $1.56 billion and is reportedly looking to spend a bigger share of its money on real estate.