It has been whispered about for months, but now it’s official: Vornado Realty Trust is offering up a palatial four-floor apartment at 220 Central Park South that is priced at a record-smashing $250 million.

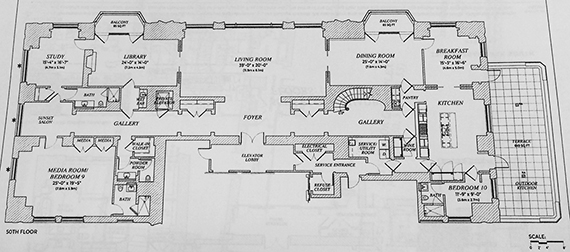

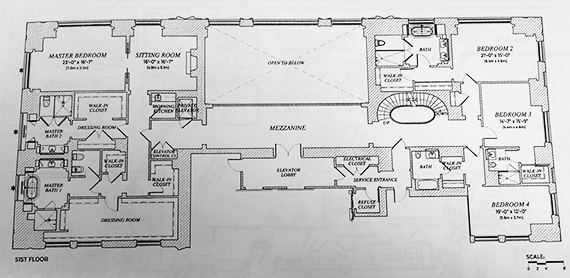

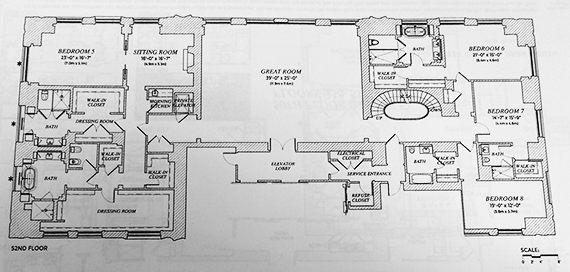

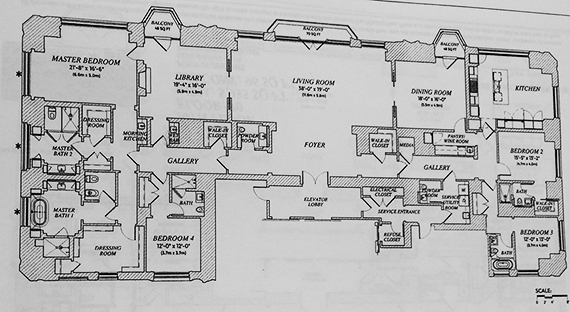

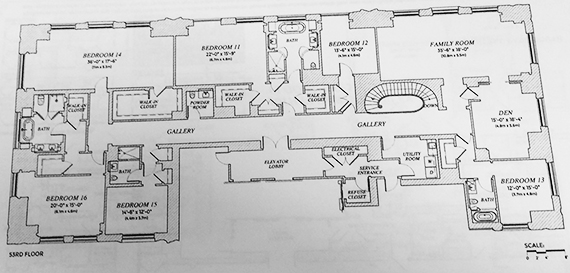

The massive condominium will encompass floors 50 through 53 of the Robert A.M. Stern-designed limestone tower, and it will span some 23,000 square feet, according to an amended offering plan filed with the New York Attorney General that was reviewed by The Real Deal. The asking price works out to nearly $11,000 per square foot.

New York’s crown for priciest apartment sale currently belongs to Extell Development’s One57, where a penthouse sold for $100.5 million in January 2015. If sold at full ask, the 220 CPS pad would blow that out of the water, and also surpass London’s One Hyde Park, where a pad traded for $237 million in 2014.

According to the AG filing, the new quadplex is a combination of an 11,000-square-foot duplex on the 50th and 51st floors that was asking $150 million, plus three other smaller (but by no means small) apartments. Units 52A, 52B and 53B were each asking between $26.3 million and $43 million.

Floor plans for the mega unit corroborate reports in recent months that more than one buyer was looking to combine multiple units at 220 CPS into one giant apartment.

Multiple news outlets reported that hedge fund mogul Ken Griffin is buying an apartment at the property for north of $200 million, and TRD reported last year that a Qatari buyer was looking to combine multiple apartments into a single, $250 million spread.

Speaking during Vornado’s first-quarter earnings call Tuesday of sales at 220 CPS, CEO Steve Roth said, somewhat cryptically, that the REIT was “now negotiating two very important deals.”

In addition to the quadplex, Vornado combined two half-floor units on the 45th and 46th floors, and retooled four penthouses, according to the AG filing.

Bucking a recent trend among developers to chop up penthouses into smaller units, Vornado replaced four duplex penthouses with slightly larger, full-floor spreads that are asking between $60 million and $62 million. (Earlier prices ranged from $45 million to $53 million.)

Penthouse 75 – a 5,000-square-foot pad – is still unlisted in the offering plan. But Penthouse 73 (9,800 square feet) and Penthouse 76 (nearly 9,000 square feet) are each asking $100 million.

The building now has 116 units, including 27 guest suites that may be purchased by buyers in the building. Those units range in price from $1.35 million (388 square feet) and $3.75 million (917 square feet).

The building’s total sellout goal is now $3.17 billion, up from $3.06 billion.

Until recently, the priciest apartment entering the New York City market was a $150 million penthouse at the Chetrit Group’s Sony Building conversion at 550 Madison Avenue. But those plans were scrapped last month when the developer sold the building for $1.4 billion to a division of Saudi conglomerate Olayan Group for $1.3 billion, as TRD first reported.

Last month, Vornado published new renderings of 220 CPS on its website, showing the tower and villa in greater detail. Vornado has secured $950 million in financing from the Bank of China for the project and, according to Roth, is spending $5,000 per square foot to build it out.