Trending

NYC multifamily sales make comeback in March

Dollar volume climbs back above $1 billion threshold

The New York City multifamily market made a strong comeback in March after sluggish sales in February, according to the latest report from Ariel Property Advisors.

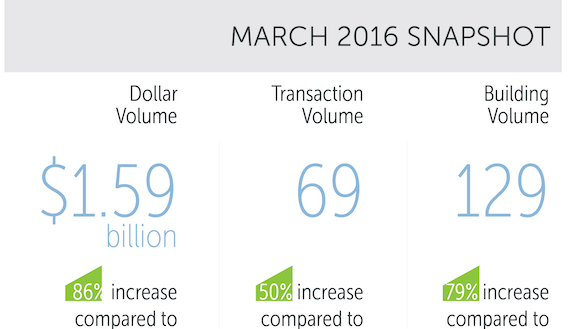

Dollar volume pushed above $1 billion after falling below the threshold in the previous month. Gross sales reached nearly $1.6 billion in March, an 86 percent increase compared to February’s dollar volume.

Transaction and building volume also saw a boost of 50 percent and 79 percent respectively, although those figures were down year-over-year. The city had 129 multifamily sales across 69 transactions.

In Manhattan, sales from 19 buildings brought in $786.3 million, a 139 percent increase in dollar volume from the prior month. A total of 936 units traded in 14 transactions. The month’s largest deal was S.W. Management’s purchase of two multifamily buildings at 355 East 72nd Street and 250 East 63rd Street for $310 million, or $831 per square foot.

The Bronx saw the most transaction and building volume with the help of a 34-building portfolio. Sales from 63 buildings toted $258.1 million, up 92 percent over February.

Other notable deals in the borough include the sale of a mixed-use building at 2691 Reservoir Avenue. Landlord Ved Parkash bought the 72-unit property for $17.3 million.

Multifamily sales in Brooklyn increased across the aboard in March. Twenty-five buildings sold throiugh 18 transactions, a modest 32 and 6 percent respectively. Sales totaled $353 million, a 121 percent jump in dollar volume over the previous month.

Greystar Real Estate Partners’ purchase of 247 North 7th Street and 248 North 8th Street in Williamsburg was the borough’s largest deal of the month. The Charleston-based fund manager paid $125 million for the pair of buildings.

March sales were the slowest in Queens. The borough saw just six sales and five transactions, a dip from the prior month and year-over-year.