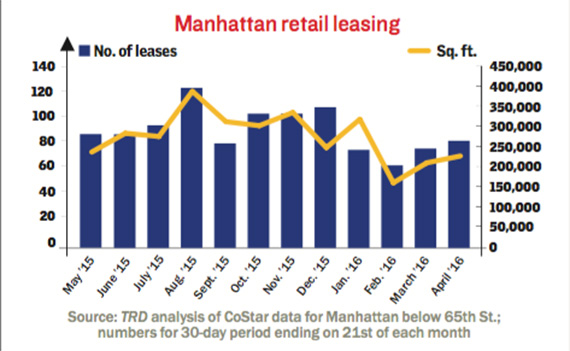

From the May issue: Retail leasing picked up last month in prime parts of Manhattan but still remains below the monthly average for the last year.

Over the past 30 days, retailers signed leases for 232,190 square feet at 83 locations below 65th Street in Manhattan. While that’s up from earlier this year, it’s still under the 280,000-square-foot average of the last 12 months.

Spooked by high prices in popular neighborhoods, retailers have pulled back, insiders said. “Any place that is super expensive is a little bit slow now,” said Chase Welles, a broker for SCG Retail.

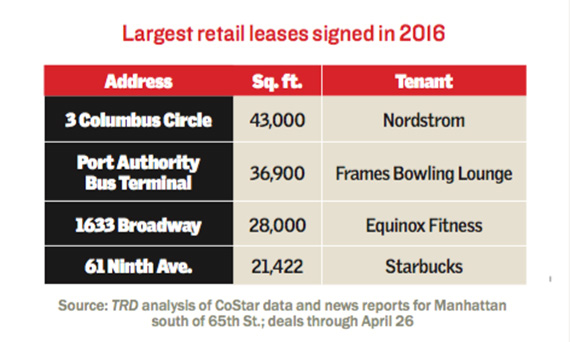

But that doesn’t mean activity is at a standstill. Some tenants have signed significant leases. Nordstrom inked a 43,000-square-foot deal at 3 Columbus Circle.

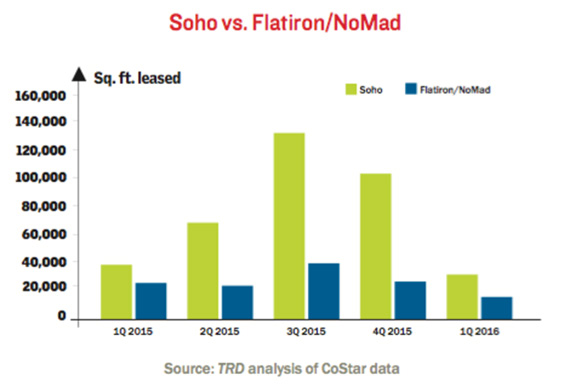

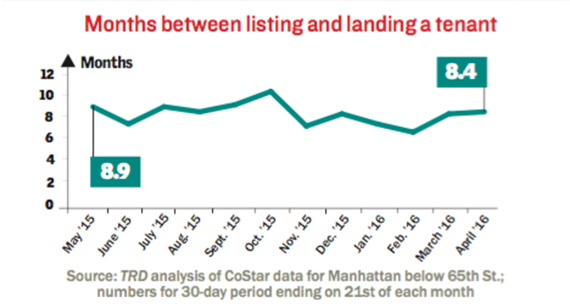

While the data has not quite caught up, brokers said it’s taking longer to land tenants in part because some think rents will start falling. And some tenants are moving to cheaper locations. “Soho will always be Soho, but there needs to be a correction,” said Newmark Grubb Knight Frank’s Thomas Citron, adding that some retailers are looking to the Flatiron District as an alternative.

But the Flatiron has seen rising rents and a drop-off in deals, too. “We saw enormous activity last summer — the most I’ve ever seen,” said ABS Partners Real Estate’s Mark Tergesen. “I don’t think demand has necessarily dropped but rising rents are creating resistance.”