The luxury residential market has logged four strong weeks in a row, with 115 sales worth a combined $950 million, including a $76.5 million sale at Macklowe Properties’ 432 Park Avenue, according to Olshan Realty.

Maybe the slowdown in the Manhattan luxury sales market is all make believe.

No. The Real Deal counted it up, and the pessimists are right: Modern aristocrats’ appetite for en suite lap pools, members-only pet spas and penthouse views of New Jersey really seems to be on the wane.

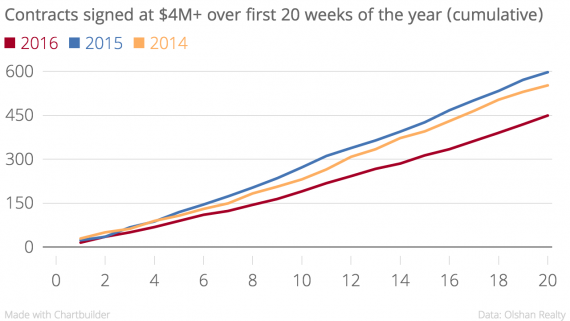

Luxury sales volume is down a stomach-churning 25 percent in the first 20 weeks of 2016 compared to the same period last year. Just 449 contracts at or above $4 million were signed so far this year, compared to 597 in the first 20 weeks of 2015, and 552 in 2014, according to a TRD analysis of data from Olshan Realty’s weekly reports.

Even the relatively strong numbers over the past month don’t change the story, but largely reflect the typical rebound from winter sales lows beginning in March. Sales volume was even larger during the equivalent four-week periods in 2015 and 2014, when 130 and 122 transactions were recorded respectively, compared to 115 this year.

So, what’s going on?

Part of it is incidental, said Olshan president Donna Olshan.

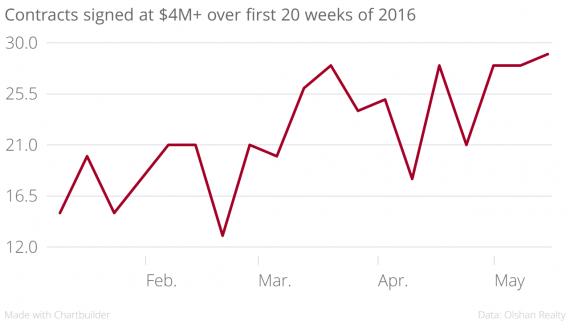

“2016 started out lousy because the stock market was tanking.” Major stock indices hit a two-year low on February 11th, Olshan pointed out. That moment stands out in 2016’s sales numbers, with luxury contracts diving and then staging a recovery.

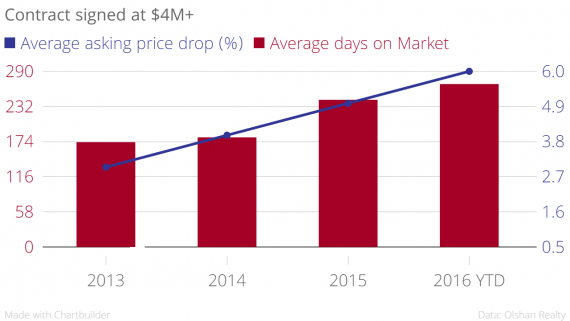

More broadly, said Olshan, there are clear signs of overpricing. So far in 2016, both the average number of days that in-contract units sit on the market and the average amount by which the final asking price is lower than the original ask have climbed, continuing a trend seen over previous years.

Analysts have pointed to a handful of long-term macroeconomic forces driving sales volume and prices: an oversupply of ultra-luxurious new development condominiums, and weak demand tied to global political instability, the rapid decline of commodity prices, especially oil, as well as a strong U.S. dollar increasing real prices for foreigners.

Industry players are responding. Major developers such as JDS Development and the Chetrit Group have either halted sales plans for marquee skyscrapers packed with luxury condos, or scrapped them altogether. Some condo builders are lowering their planned sellout prices, while others are aggressively cutting asks, notably on penthouse units, a StreetEasy analysis found in April.

Other developers say the slowdown in the luxury market is mostly about perception, blaming the press for sullying the mood.

“There’s no liquidity issue, there’s a mood issue,” Michael Shvo, who’s in the planning stages of a high-rise condo at 125 Greenwich Street, said at The Real Deal‘s New York showcase on May 12. “The only thing wrong with the market is an oversupply of overpriced, average apartments. Those are in buildings that should not have been built and they’ll suffer.”

Sales haven’t fallen off entirely, of course.

“Overall, the contract activity is somewhere between 2012 and 2013 levels,” said Olshan. “Which is healthy but not overheated.”

“2013-2015 will go down as the golden years of new development,” Olshan added.