Manhattan’s retail property market has been growing at a furious pace for years, but as tourism growth tapers off and the U.S. dollar appreciates against tourists’ currencies, that’s starting to change.

Average prices per foot have fallen over the last three quarters after peaking in mid-2015, according to retail real estate sales data from Real Capital Analytics.

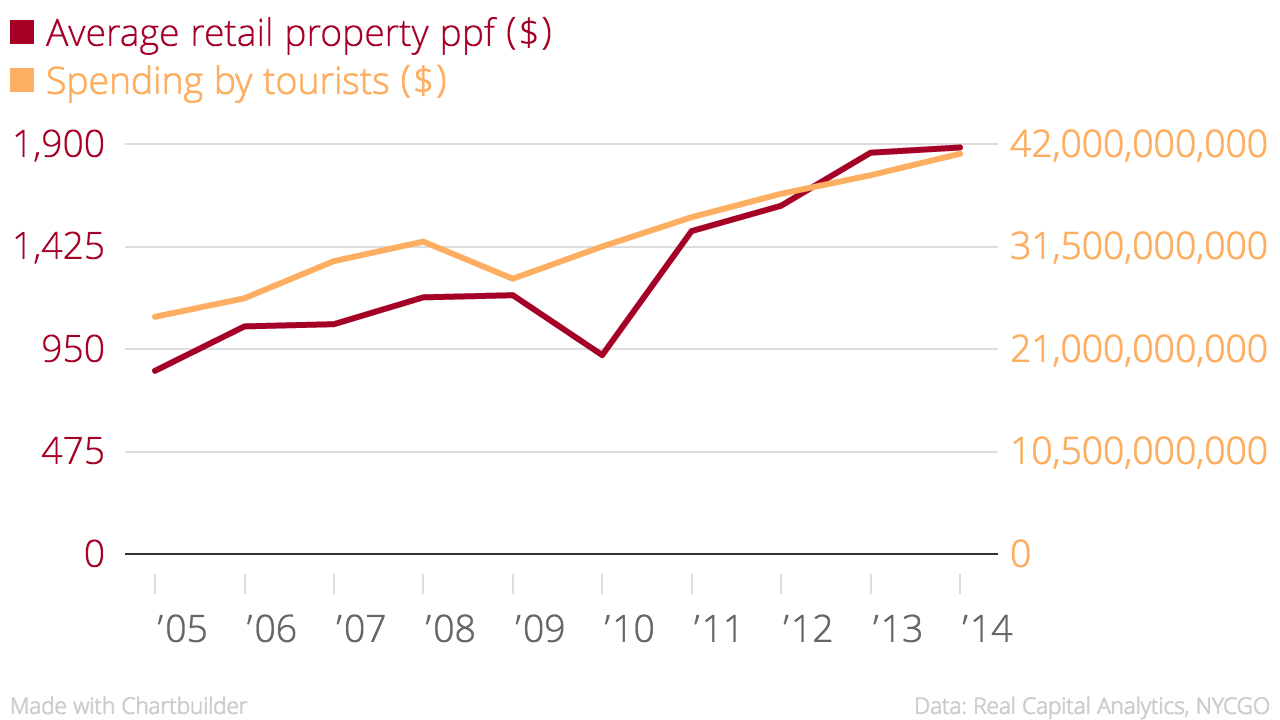

Both the long rise and recent fall, brokers say, has to do with the economic impact of shifts in the city’s tourism rates.

“There’s a lot of consumer spending and a lot of disposable wealth in New York. There always has been,” said JLL investment sales broker Stephen Shapiro, “but the real driver is tourism spending.”

The number of international travelers visiting New York City reached 12.3 million in 2015, up from 7.3 million in 2006.

While those numbers have continued to grow over the past year, their rate of increase has slowed markedly. And that’s probably not just because some of them got lost or accidentally caught a MetroNorth train at rush hour.

Fewer tourists means less retail spending, which means retailers can’t afford to increase rent payments, which ultimately lowers the cap rates and potential sales prices of retail properties.

And rents are indeed falling, according to the Real Estate Board of New York’s Spring retail report, which found asking rents down, if relatively slightly, in 10 of the 17 Manhattan retail corridors surveyed.

“There’s a linkage between rising property values and rising rents,” said CPEX brokerage co-founder Tim King. “When rents rise, so will property prices,” and vice-versa, he said.

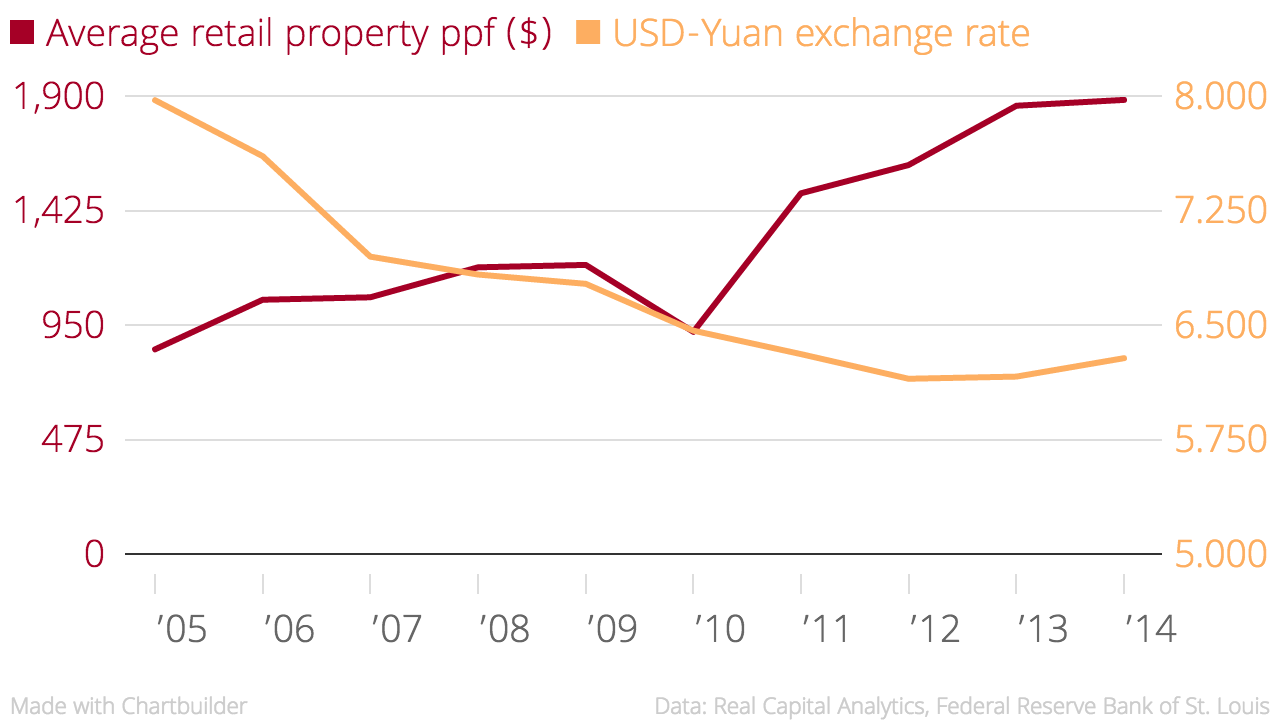

Part of what’s driving that trend, in turn, is the strengthening of the U.S. dollar against travelers’ native currencies.

As the dollar appreciates against, say, the Chinese yuan, Chinese travelers lose relative purchasing power, reducing the amount they’re able to spend per person.

And the Euro too has struggled, meaning travelers in countries like France and Germany — both on the top 10 list of international visitors to New York City — are also seeing their buying power dwindle.

The same forces influence the buying power of foreign investors.

“It has a lot to do with global trends,” said King. “Ten years ago there was significantly less foreign investment than there is today.”

Still, it’s important not to over-interpret. The total number of retail properties traded is relatively low, just 95 since November, or just over 13.5 per month. That means individual sales with very high or very low price per square foot figures can have a powerful effect on the averages.

That effect has been very much in play over the past several quarters, according to Jim Costello of Real Capital Analytics.