The city loses billions of dollars in taxes because flaws in the way property values are assessed. In many cases it is the billionaires themselves that benefit from these flaws. Now SITU Studio has created stunning visual representations of those inequalities.

SITU Studio’s exhibit at Storefront for Art and Architecture in Soho is using the buildings along Central Park to point out how the city’s property tax structure assigns higher real property taxes to renters than it does to the owners of trophy condos on Billionaires’ Row, according to 6sqft. That inefficiency costs the city millions in tax dollars every year.

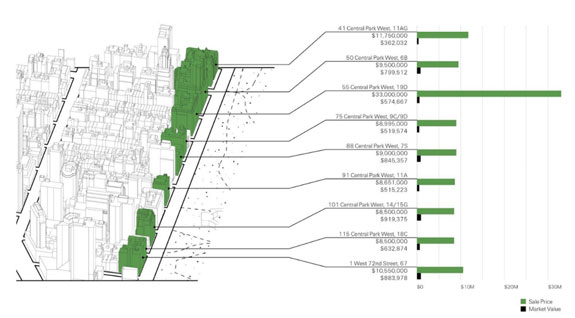

SITU used acrylic bands to show the disparity between the taxed value of these properties and their real market value.

A visualization of the disparity between assessed and market value of properies. Models created by SITU Studio. Photograph by Patrick Mandeville

“The most valuable rental buildings in Manhattan are valued by the Department of Taxation and Finance at well under $500 per square foot. The market has seen luxury condo sales typically made at a much higher expense per square foot—often in the $4,500 range,” the study says.

The relies on data from New York University’s Furman Center for Real Estate, a 2015 report by CityLab, and Max Galka’s visualizations of property-tax undervaluation shown in charts at Metrocosm.

Image SITU Studio

According to the project, the greatest disparities are found between Central Park West and Park Avenue. The undervaluation of the properties in this sliver of Manhattan alone comes to a $5.2 billion, according to 6sqft. [6sqft] —Christopher Cameron