UPDATED, Aug. 12, 6:05 p.m.: The Park Hyatt in Midtown’s luxury tower One57 is one of more than 30 New York City hotels currently for sale, sources say, in what could become a litmus test for the weakening hospitality market.

(Credit: JLL)

Jeffrey Davis, who heads JLL’s New York hospitality division, called the number of hotels on the market “unprecedented.” The spike comes as observers stress about the near-term strength of the hotel market amid declining hospitality revenues and volatility in the financial markets.

“We are sort of in the eye of the hurricane,” Davis said, adding that he expects the market to rebound in 2018.

Last summer, Real Estate Alert reported that Hyatt Hotels tapped Hodges Ward Elliott to gauge interest in the Park Hyatt New York, a 210-key five-star hotel which sits on the lower levels of Extell Development’s One57. But real estate investment markets froze up in late 2015 and early 2016 amid turmoil in the global markets, and a sale never materialized.

More recently, Hyatt has had talks with potential suitors for the property, sources said, although no deal appears imminent. “If the right buyer stepped up, Hyatt would sell that hotel tomorrow,” said one well-connected broker. In an earnings call earlier this month, Hyatt’s CEO Mark Hoplamazian said the firm is in “active discussions” to sell properties, but didn’t say whether the Park Hyatt was one of them.

Representatives for Hyatt and HWE declined to comment on the potential sale of the Park Hyatt. But if the 2015 sale of the nearby Baccarat hotel for around $2 million per room to Sunshine Group is any benchmark, the property could command well over $400 million. That would make it the priciest single-asset Manhattan hotel sale of the year to-date, in a market that has slowed considerably from an exuberant 2015.

Last year, trophy deals like the $1.95 billion sale of the Waldorf Astoria hotel to Chinese insurer Anbang and the $805 million sale of the Palace hotel to Korea’s Lotte Group pushed total hotel sales volume to a record $6.6 billion – more than double the previous high of $3.1 billion reached in 2011 – according to JLL.

There were nine New York City hotel sales for $200 million or more in the first seven months of 2015, according to Real Capital Analytics. In the first seven months of 2016, however, there were merely two: Hyatt’s sale of the Andaz hotel at 485 Fifth Avenue to Japanese investor Takenaka for $215.2 million (or around $1.17 million per room), and the sale of the Essex House hotel to Anbang as part of Anbang’s $6.5 billion acquisition of Strategic Hotels & Resorts from the Blackstone Group.

Some of that slowdown can be explained by a slide in global capital markets in late 2015 and early 2016 that froze property sales for several months. But even after markets recovered in March and investment sales activity picked up again, investor interest in hotels remains somewhat muted.

“A lot of sellers are waiting,” said Douglas Hercher, principal at hospitality brokerage RobertDouglas. “We are clearly in a period where there’s been a little bit of a dip in performance. Cap rates are going up for hotels generally. In my mind that’s appropriate.”

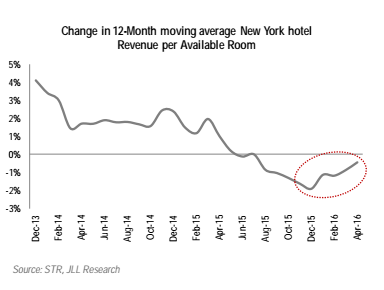

Average New York hotel revenue per room has been falling every month since mid 2015 despite a strong tourism market (see chart), due in part to competition from Airbnb and in part to an uptick in hotel construction that has added to the overall supply of rooms. New York’s revenue per available room (a common metric for hotel revenues) fell by 1.2 percent between 2014 and 2015 to $306 according to JLL – the first dip since 2009.

Observers expect this trend to continue in the near future, which makes it harder to justify high asking prices.

Real estate investment trusts, once key drivers of demand for New York’s hotels, have mostly held off from buying this year, according to JLL’s Davis. Most hotel REITs currently trade at significant discounts to the net asset values of their properties, which could indicate that investors think hotel values are on the way down.

“Typically these corrections last a while, it’s a two to three year thing normally,” said Bob Knakal, head of New York investment sales at Cushman & Wakefield. He believes the dip won’t be dramatic, in part because there hasn’t been a credit crunch or stock market crash that could accelerate a downturn. “There hasn’t been anything to make a correction happen other than the cyclical nature of the market,” he said.

As The Real Deal reported in April, the surge in hotel construction appears to already be over, which could help stabilize hotel revenues in the long run.

Jay Morrow, a broker at HWE, said investors currently looking at New York hotels are primarily those with longer holding periods and the capital structure to withstand a temporary dip in the market. This group includes insurance companies, pension funds and sovereign wealth funds. Overseas buyers were behind the four most expensive New York hotel sales of the year: the Essex House and Hyatt Andaz sales, as well as the $170 million sale ($805,000 per room) of the Soho Hotel to German asset manager Commerz Real and the $169 million ($570,000 per room) sale of the Hilton Homewood Suites hotel on West 37th Street to Qatari investment firm Alduwaliya Asset Management.

“I think (the market) will be a little slower until people have clarity on where fundamentals are headed,” Morrow said. “On other hand, when there’s uncertainty it creates some great buying opportunities.”

Correction: an earlier version of this included wrong per-room sales prices.