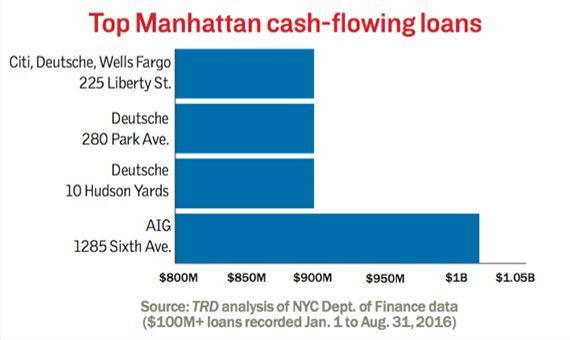

Deutsche Bank has been the most active lender this year on pricey Manhattan cash-flowing properties, a review by The Real Deal found.

The German bank provided at least $3.8 billion of approximately $19 billion in deals of $100 million or more that were recorded through August 31, 2016. Deutsche lent $900 million on Related Companies’ 10 Hudson Yards office building, which opened earlier this year, and another $900 million on SL Green Realty and Vornado Realty Trust’s jointly owned 280 Park Avenue.

Despite some turbulence, the cheap debt market helped lower the cost of issuing preferred stock, too. Ashish Parikh, CFO at Hersha Hospitality Trust, told investors on an earnings call in July that the hotel REIT raised $192.5 million through preferred shares this year, paying a 6.5 percent dividend rate, “the lowest cost of capital in company history.”

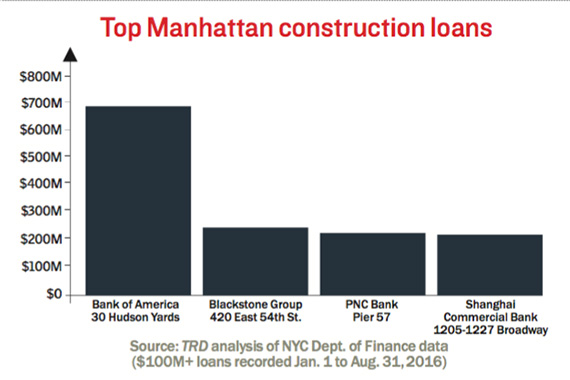

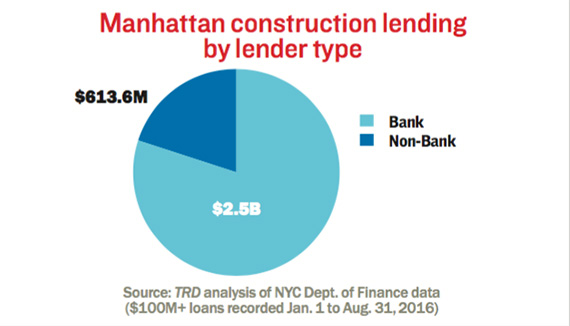

Meanwhile, lenders provided $3.1 billion of construction loans over $100 million so far this year in Manhattan. Bank of America led the biggest commitment, a $690 million loan to Related for its 30 Hudson Yards development project.

PNC Bank issued the third largest loan so far this year, to a development group led by RXR Realty [TRDataCustom], for its 480,000-square-foot project at Pier 57. “You’ve got to be a known entity with real projects and a real balance sheet to get the good terms,” RXR’s William Elder told TRD.

Commercial Financing 2011-2016 – 51,000 NYC transactions – $500/borough

Commercial Financing 2004-2010 – 71,000 NYC transactions – $500/borough