Tenants squabbling, hemorrhaging cash and litigating over timeshares? It’s a scene reminiscent of Florida or Las Vegas during the 2008 financial crisis, except that it’s playing out in the gilded halls of one of Fifth Avenue’s finest five-star hotels. The owners of 107 fractional timeshares in the St. Regis Hotel, built by John Jacob Astor IV himself, are taking the historic hotel to court, alleging that the hotel’s management hollowed out the value of their investments.

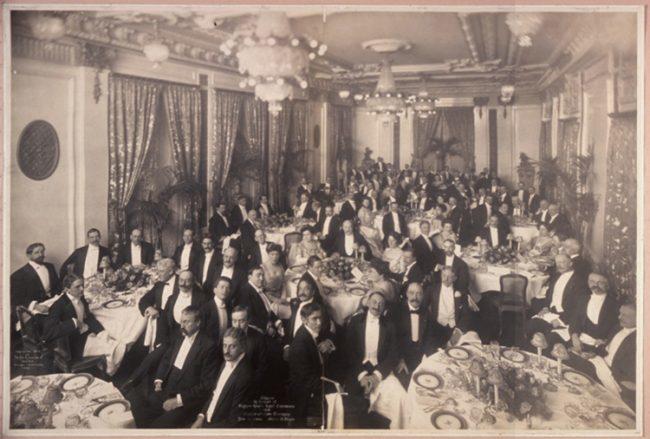

Banquet in honor of Arturo Toscanini at The St. Regis, 1908. Image via Wki Commons

The plaintiffs, who paid an average of $445,000 for a fractional share of a “Club Suite” — luxury units on specially reserved floors — claim that the value of their shares has dropped more than 60 percent since 2008 due to mismanagement by the hotel, which is owned by Starwood, according to the lawsuit.

The plaintiffs point back to 2008, when the hotel added additional inventory to the “club units,” by converting unsold condos into so-called “fractured offerings” (basically timeshares where you own a piece of the real estate not just the right to use), thus diluting the value of the previously sold shares.

“[The hotel’s] wrongful conduct was part of a plan to foist upon plaintiffs losses they would otherwise accrue as a result of their failure to sell suite units [wholly-owned condominiums] in the crumbling economy, while unjustly enriching themselves.”

The hotel is currently marketing 28-day-per-year fractional timeshares for just $165,000, according to Curbed. And share owners contend the value of their units could continue to plummet due to recent developments.

The St. Regis

In May, Starwood sold the St. Regis’ fractional timeshare program to Interval Leisure Group (ILG), a large timeshare operator. According to the lawsuit, ILG now intends to merge unsold shares in the St. Regis with another, lower-end, timeshare program with a quarter-million participants, thus devaluing the shares even further.

“Plaintiffs paid premium prices and continue to pay very high annual maintenance fees based on a promise of exclusivity,” court papers state. “But defendants flagrantly ignored the club offering plan’s requirements and prohibitions, including secretly flooding the residence club with new inventory as the country was sliding into recession, abandoning any attempt to sell unsold club interests, converting unsold club interests into a permanent inventory of rentals and renting them on a massive scale, and making plaintiffs pay for the increased wear and tear caused by the contractually unauthorized rental program, among other things.”

So what do these exclusive and well-heeled investors want? Potentially a bundle. They are requesting a jury trail – and as Hulk Hogan recently proved, some juries are more than willing to make defendants pay staggering sums – for an amount to be proven at trial.

However, Starwood and the St. Regis deny any wrongdoing or mismanagement, intentional or otherwise.

“Since its development in 2006, the residence club at the St. Regis, New York has provided world-class experiences to its owners,” David Calvert, a spokesperson for Vistana Signature Experiences, the subsidiary of ILG that manages the residence club, told LLNYC. “As to the claims of this complaint, we have fulfilled and will continue to fulfill our obligations and plan to defend this lawsuit accordingly.”

It’s a good thing John Jacob Astor IV isn’t around to see his beloved hotel facing down a lawsuit this — dare we say — titanic.