Leaner times may be coming for doormen and pet groomers. New York’s rental market is in the doldrums and the luxury market has taken the worst of it, new research shows.

Luxury rents have fallen or stagnated in most neighborhoods while non-luxury rents continued to rise, causing the price gap between them to shrink.

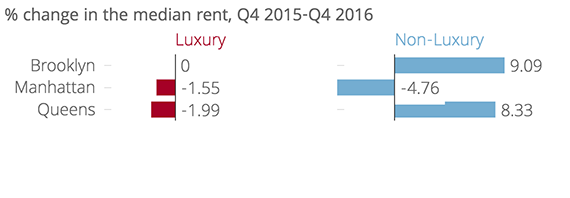

In Brooklyn, the median luxury rent in the fourth quarter of 2016 was at $3,150, flat from the same period last year, while the non-luxury rent rose 9.09 percent to $2,400, according to rental listing site RentHop. The gap also shrank in Queens, with luxury rents falling 1.99 percent year-over-year to $2,764 and non-luxury rents rising 8.33 percent to $1,950. Manhattan was the only borough where luxury rents (down 1.55 percent to $3,495) and non-luxury rents (down 4.76 percent to $2,800) both fell.

RentHop defines luxury properties as buildings with a gym or doorman. It’s not a clean definition – some very expensive buildings have neither – but it’s a good proxy for higher-end properties.

In recent years, developers have been flooding the market with high-end rental buildings targeted towards yuppies and equipped with amenities like gyms, game rooms, and pet spas. But the supply surge means renters now have a wealth of options to choose from, and landlords can’t expect to command the same premiums they could just a year ago.

On a neighborhood level, some of the biggest decreases in the price gap between luxury and non-luxury were recorded in West Harlem and Astoria. Shane Leese, a data scientist at RentHop, said developers in these neighborhoods have been building luxury rentals in anticipation of a future spike in demand that has yet to materialize.

The fact that Manhattan’s price gap didn’t shrink can be explained by the fact that non-luxury apartments there increasingly compete with the outer boroughs for renters, putting downward pressure on rents.

The fact that Manhattan’s price gap didn’t shrink can be explained by the fact that non-luxury apartments there increasingly compete with the outer boroughs for renters, putting downward pressure on rents.

Renthop’s data doesn’t break down concessions, which have been rising across the city as landlords look to lock in renters without actually lowering rents.

Last week, apartment landlord Equity Residential said rental revenues at its New York buildings fell by 3.1 percent in 2016 and could fall by another 1.8 percent in 2017. “We are already hearing some crazy stuff like three and four months free on 12-month leases,” the firm’s COO David Santee said on an earnings call, speaking broadly about the rental market.