Condominium sales at Trump Tower have surged since Donald Trump announced his run for president in mid-2015, and the tumultuous early days of his administration don’t appear to have slowed the momentum.

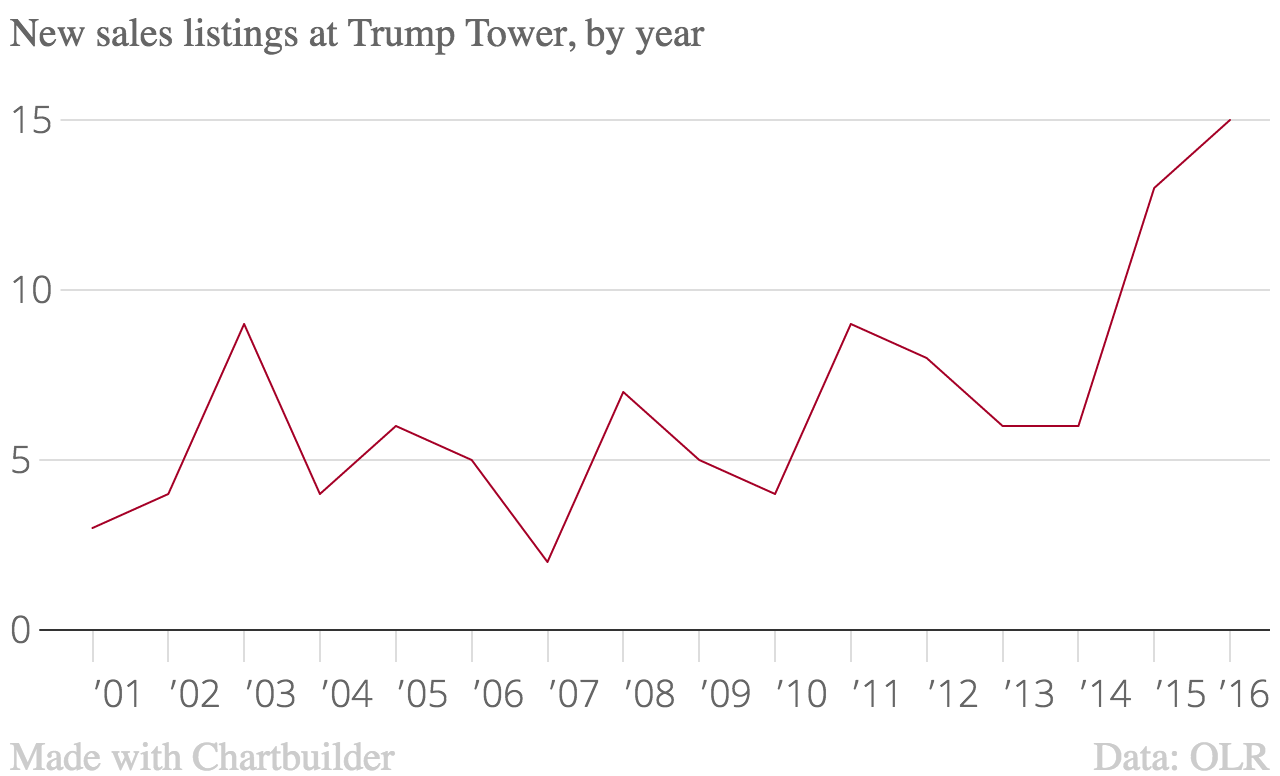

The number of annual apartment sales at Trump Tower jumped to 22 in 2016, according to StreetEasy analyzed by The Real Deal. That’s up from 15 in 2015 and 11 in 2014, even as luxury sales fell across the city (see chart). Winter is normally a quiet time in the condo market, but as of Monday there were 21 active sales listings at Trump Tower, Streeteasy data show.

The seller of the tower’s most expensive current listing, a 58th-floor combination pad asking $11 million, hails from Mexico. Construction heir Elias Sacal bought his two apartments in January 2015, six months before Trump announced his candidacy. He listed them for sale again little more than a year later, in March 2016. Sacal’s broker, Rana Williams of Keller Williams NYC, declined to comment on whether politics played a role in his decision to sell. The Mexican government has repeatedly clashed with the Trump administration over its plans to build a wall on the border separating the two countries.

On-Line Residential, a listings platform, recorded six new condos listed for sale in January and February of 2017 — the highest January/February total since at least 1997. OLR doesn’t record all listings, and it’s likely that previous years have seen more units hit the market that weren’t tracked by the system. Still, OLR’s numbers seem in line with the general trend over the past two years.

Coincidentally or not, mid-2015 marks a watershed in sales activity at the building. Just 11 units sold in 2014 and the following year started similarly slow, with five sales recorded in the first half of 2015, according to Streeteasy. But in the second half of the year, after Trump used the building’s ostentatious lobby to announce his run on June 16, sales surged, bringing the annual total to 15.

Brokers active at the building insist Trump’s politics have no relation to the uptick at the building. Douglas Elliman’s Tal Alexander, who recently sold a one-bedroom apartment on the 32nd floor along with his team and Somerset Residential Real Estate’s Michael Balanevsky, said politics or security never came up in his conversations. It was initially listed for just shy of $3 million in January 2016. The brokers reduced the asking price twice, ending up at $2.195 million in May. The property sold at that price last week.

The price drop was simply a matter of initial inflated expectations, Alexander said, and that demand for the unit was strong. “We all know 56th and 5th Avenue,” he said. “For a Midtown buyer it doesn’t get any more prime than that.”

Echoing a trend seen at other high-end condo buildings across the city, eight of the 21 current Streeteasy listings have seen their asking prices chopped, and none raised their prices. A two-bedroom duplex on the 37th and 38th floors, for example, listed for $6.9 million in August 2015, now wants $5.995 million. In January, Bloomberg reported prices at the building’s rental units fell last year, in part because residents have to deal with protesters, metal gates and the Secret Service now that they share a home with the first family.

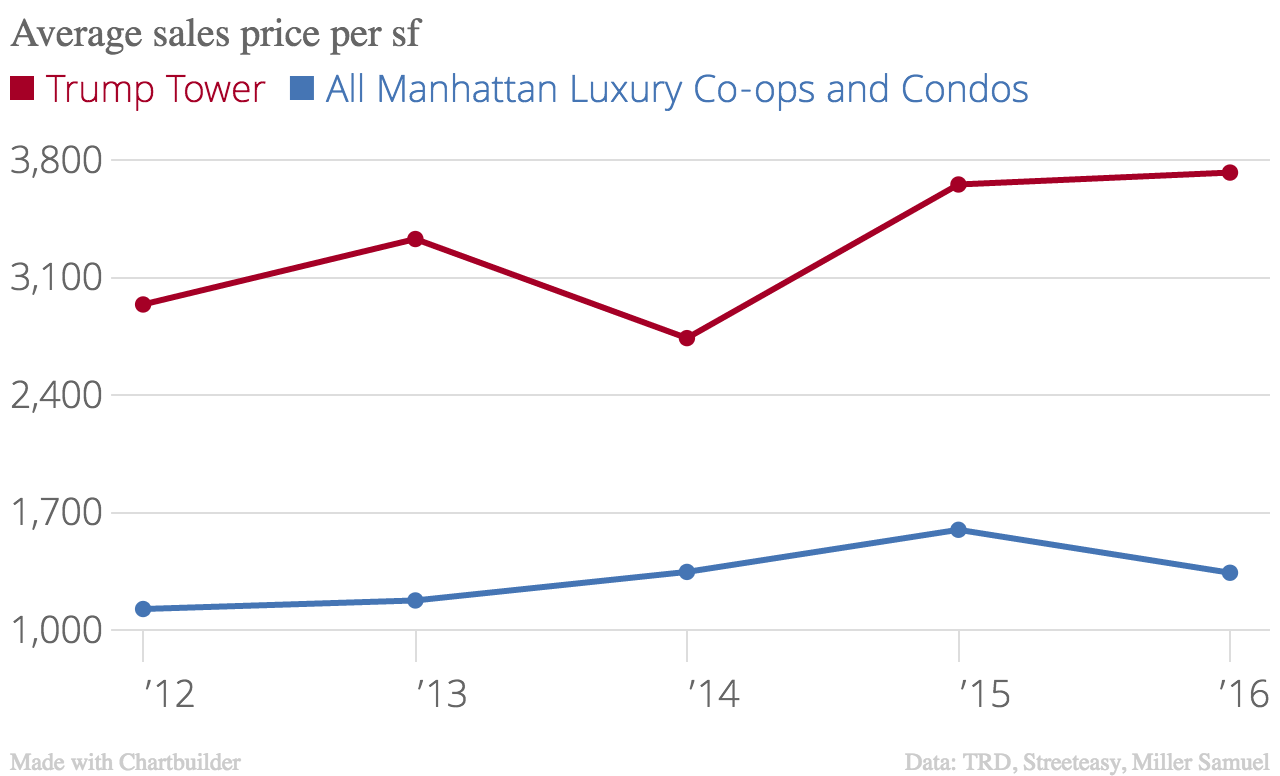

With prices falling across the city, the cuts at Trump Tower are hardly enough to paint the picture of a building that’s falling out of favor with wealthy buyers. The building’s average sales price per square foot even increased slightly between 2015 and 2016, in part because more pricey apartments on higher floors sold (see chart). In other words: there still seems to be considerable demand for apartments in the tower.

“If you got some large, renovated apartments with views, units will trade if they are priced right,” said Donna Olshan of Olshan Realty, who publishes a weekly report on Manhattan’s luxury apartment market. “This goes for any building.”

Town Residential’s Debra Stotts, who has sold several Trump Tower apartments, said sales at the building are going “really well.” While units in new Midtown condo towers come with sky-high asking prices, Trump Tower offers fancy units with similar views at lower prices, she claimed. This kept the deal volume up even as sales in newer buildings slowed or halted altogether.

“There’s going to be those who want to be there,” Stotts said, “and those who don’t want to be there.”