At the first House Judiciary Committee hearing on immigration since Congress reconvened in January, the subject was not President Trump’s executive orders or recent deportation crackdowns, but instead the EB-5 investor visa, a 25-year-old pilot program that has become a pet fundraising vehicle for real estate developers.

Senators Patrick Leahy (D-VT) and Chuck Grassley (R-IA) joined members of the committee Wednesday to testify on program reform, urging Congress to make major changes that would push EB-5 money into more underserved communities rather than luxury projects in affluent urban neighborhoods.

Both Grassley and Leahy’s testimony cited an uptick in fraud and abuse in EB-5, a program that has enjoyed incredible popularity in recent years as a key means for New York developers to source highly sought after mezzanine debt in their capital stack. The senators decried what they said was a disproportionately small share of EB-5 money going into projects in areas with high unemployment, in part due to the control regional centers have had over “gerrymandering” those areas.

“For some developers, any change to the status quo is a threat to their bottom line,” said Leahy, whose home state of Vermont is also home to perhaps EB-5’s most famous fraud scandal at the Jay Peak ski resort. “And Congressional leadership has allowed a couple of powerful developers who exploit this program’s flaws to derail critical reforms. That is unacceptable. The worst abusers of a government program should not be given veto power over its reform.”

The Chairman of the House Judiciary Committee, Rep. Bob Goodlatte (R-VA), echoed many of Grassley and Leahy’s comments in his own statement and also took a shot at so-called gerrymandering. Goodlatte quoted extensively from a glitzy ad spread promoting the Hudson Yards (developed by Related Companies and Oxford Properties Group) in the September issue of Vogue, a colorful example of how current program rules make it easy to funnel millions into luxury real estate projects.

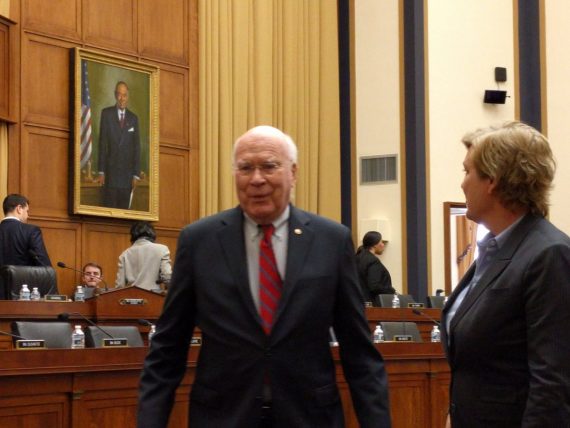

Patrick Leahy (Credit: Will Parker)

Rep. Jim Sensenbrenner (R-WI) brought up the ways regional centers have created custom TEA districts designed to allow more investors to get in at the current minimum of $500,000, a number that hasn’t budged since the program began 25 years ago.

“The exception swallowed the rule,” Sensenbrenner said.

Without a reauthorization by congress, the EB-5 program will sunset on April 28. The Department of Homeland Security, which administers the program, will continue to take stakeholder input on its proposed rules for EB-5 until that time, but President Trump could direct the department to drop any such rules, which would put more pressure on congress to enact reforms through legislation.

Representatives did bring up the program’s economic benefits and its ability to raise capital for projects that otherwise might not be built. Rep. Zoe Lofgren (D-CA) mentioned two such projects in her district, which includes the city of San Jose, and urged care in adopting any changes that “would reduce the overall investment” amount.

Members of committee then heard testimony from a panel of stakeholders, researchers and critics. Angelique Brunner, owner of EB-5 Capital and spokesperson of the EB-5 Investment Coalition, criticized proposals by the Department of Homeland Security that would allow the government to assign Target Employment Areas (TEAs) by census district. Over the course of the hearing she stated several times that proposals to raise the minimum investment threshold for a green card from $500,000 to $1.35 million is more than the market can bear and insisted the number should be less than $1 million.

During the Q&A after the panel, the only member of the committee who appeared uncritical of the current TEA system, which allowed Hudson Yards to be drawn together with a public housing complex in Harlem, was Rep. Jerry Nadler (D-NY). He agreed with Brunner’s assessment that workers’ commuting patterns should be factored into an analysis of the benefits of projects that may not physically lie in underserved neighborhoods. Sen. Chuck Schumer (D-NY), who was not at the hearing, has expressed similar views.

Focusing on census tracts as the DHS rules propose, Brunner said in the exchange, “completely ignores any principle of economic development.”

“You really have to look at the [wider] area in a whole different light,” she said.

When the panel was asked by Rep. Darrell Issa (D-CA) if, in the event EB-5 was was started from scratch, would if it be better if money only benefited underserved areas, all the panelists, which in addition to Brunner and Walls included a representative for the Government Accountability Office, a policy director at the Center for Community Progress, and a fellow at the anti-EB5 Center for Immigration Studies, responded with “yes,” although how “underserved” should be defined is still what’s up for debate.

There were still other members of Congress who seemed to reject the basic premises of an investor visa program. Tea Party favorites Rep. Steve King (IA) and Rep. Louie Gohmert (R-TX) both expressed concerns over the possibility of unwittingly allowing criminals or terrorists to enter the country through the visa program.

King asked the panel if Saudis sympathetic to terrorism or those tied to drug cartels might try to get entry to the US through EB-5. If such people were strategizing entry, King said, they “would look at the EB-5 program as the perfect tool for access into American society.” King also expressed skepticism that the price of an American green card should be below $1 million, citing much higher costs of entry in some other developed nations.

Gohmert later chided the committee for spending its time trying to peg a price on “prostituting our own visas” instead of “…figuring out whether these people are going to be good and moral…”

“America has degenerated to the point that our soul is for sale,” Gohmert continued. “…Give us your immoral, your degenerate, as long as they have money, the message is we want them in America and we’ll give them a visa to get their money.”

After the hearing, Ron Klein, a former Florida congressman and lobbyist for Holland & Knight, whose clients include the US Immigration Fund, a major EB-5 regional center, told The Real Deal that a lack of attendance by committee members was part of why the proceedings sounded so one-sided. And many of the members don’t have very extensive knowledge of how EB-5 works, Klein said. “I don’t think you necessarily got a broad representation of the people who have been paying attention on EB-5,” he said.