Trending

Evictions surge at Hialeah’s luxury apartment projects Shoma Village, Pura Vida and Manor

Evictions surge at Hialeah’s luxury apartment projects Shoma Village, Pura Vida and Manor Lawmakers reach sweeping housing deal with “good cause eviction,” new 421a

Lawmakers reach sweeping housing deal with “good cause eviction,” new 421a Charles Schwab slashing Chicago office space with big subleases

Charles Schwab slashing Chicago office space with big subleases Tony Park and Elad Dror take a gamble on Koreatown office-to-resi conversion

Tony Park and Elad Dror take a gamble on Koreatown office-to-resi conversionUS mortgage rate drop could cause spike in home sales

Average rate on 30-year mortgage was 3.9% last week

U.S. mortgage rates fell below 4 percent last week, which may encourage a rush of home buyers.

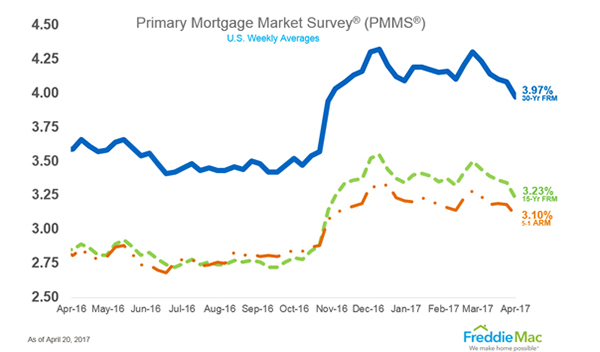

Last week, the average rate on a 30-year fixed-rate mortgage was 3.9 percent, the Wall Street Journal reported, citing data released by Freddie Mac. It’s the first time rates have dropped below 4 percent since November. A week earlier, the rate was 4.08 percent and in mid-March it was 4.3 percent, according to the Journal.

Mortgage rates jumped following Donald Trump’s presidential win, after hovering slightly above 3.5 percent for the 30-year fixed-rate mortgage for most of 2016. The Federal Reserve raised interest rates last month, and officials have foreshadowed two more rate raises this year.

However, Treasury yields came close to a five-month low last week, driven by investor concerns about unrest in Syria and North Korea, and because of little development on tax reform.

Economists say a mortgage rate decline could drive more home buyers towards investing, as lower rates mean reduced mortgage repayments.

“Almost the entirety of the Trump bump [to mortgage rates] has been washed away,” Keith Gumbinger, a vice president at HSH.com, a mortgage-information website, told the newspaper.

“It’s driving more demand into a market that doesn’t have much in the way of supply,” he added. [WSJ] — Miriam Hall