Home prices across the country are rising much faster than incomes, sparking concerns from economists and brokers that the market may overheat.

In February, home prices jumped nearly 6 percent from the month before, the Wall Street Journal reported, citing the S&P CoreLogic Case-Shiller U.S. National Home Price Index. That means prices are now nearly 40 percent higher than they were at the depth of the crash in February 2012. By comparison, incomes jumped just 3 percent in February from the month before, and 12 percent from February 2012, according to the newspaper.

Some parts of the country are seeing bidding wars, and some buyers are even skipping home inspections. The lack of construction, coupled with labor shortages and zoning regulations is pushing up prices, the Journal reported.

However, economists told the newspaper there is little indication the market is headed for a crash. They said if markets do overheat, it will result in slightly diminished home prices or a stretch where prices stay flat. Most economists predict prices will continue to go up for a few more years, due to the ongoing supply glut.

The market “is not going to burst, it’s going to contract” with falling sales volume, Nela Richardson, chief economist at Redfin [TRDataCustom], told the newspaper. “You might still see what looks to be a robust market because prices are really strong, but that doesn’t mean it’s a broad market,” Richardson said.

During the first quarter, Manhattan’s median apartment sale price was $1.1 million, a 3 percent decline from last year. [WSJ] — Miriam Hall

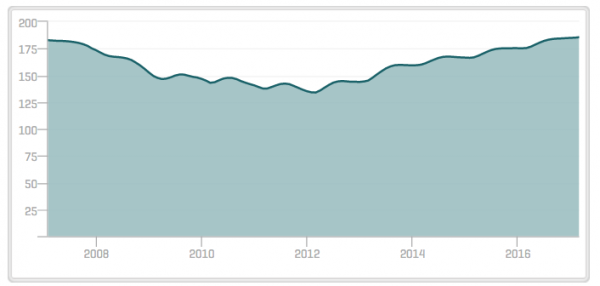

(To view historical Manhattan condo sales, click here)