Brooklyn’s commercial real estate sales volume continues to tumble, and that may have something to do with an unexpected culprit: stricter enforcement of rent stabilization.

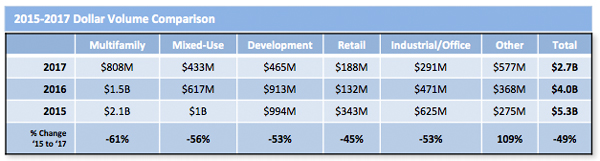

Investors bought $2.7 billion worth of properties in the borough in the first six months of the year, down from $4 billion a year earlier and a 49 percent decrease from a record $5.3 billion in the first half of 2015, according to a new report from brokerage TerraCRG [TRDataCustom].

TerraCRG’s Ofer Cohen said that after 18 months of little to no rent growth, buyers are increasingly reluctant to pay top dollar for properties, which has in turn discouraged landlords from bringing their properties to market. “Discretionary sellers aren’t even attempting to sell their properties right now because they know they’re not going to hit their price,” he said.

Cohen also speculated that the drop in multifamily deals reflects the citywide rent freeze on stabilized leases and stricter enforcement of J-51 stabilization, which has made it harder to turn a profit.

Last year, Gov. Andrew Cuomo ordered landlords to register units under the J-51 tax abatement program as rent stabilized, and tenants have filed a flurry of lawsuits against landlords who failed to do so. Meanwhile, the Rent Guidelines Board froze stabilized rents two years in a row and only approved a modest 1.25 percent rent hike in June on one-year leases signed between October 2017 and September 2018.

Development sites were particularly hard hit, with deal volume collapsing to $465 million from $913 million last year, according to TerraCRG’s report. The multifamily market, Brooklyn’s largest asset class by a margin, also had a rough six months — sales fell to $808 million from $1.5 billion last year.

Industrial and office sales also fell, to $291 million from $471 million last year. Retail sales rose but are still down 45 percent from 2015.

But it’s not all bad news. Cohen said that while dollar volume is down, there are still a lot of deals happening — they just tend to be smaller. TerraCRG still recorded 698 deals in the first half of 2017, down slightly from 771 a year earlier. And Cohen said he is seeing “encouraging signs of increased activity” in the new development market buoyed by 421a’s successor program, Affordable New York.

For example, yesterday The Real Deal reported that Yoel Goldman, Hakim Organization and the Property Markets Group are buying one of Gowanus’ largest development sites for $50 million.

(It should be noted that a separate report from Ariel Property Advisors, using a different methodology, found 570 Brooklyn investment sales transactions totaling $3.58 billion in the first half of 2017. That report similarly found that multifamily property trades declined dramatically, as did dollar volume on the development side.)

Brooklyn was hardly the only part of New York that saw investment sales volume drop in the first half of the year. Last week, TRD reported that Manhattan investment-sales fell 55 percent, according to Real Capital Analytics. Meanwhile investment sales in Upper Manhattan only dropped 58 percent, according to Ariel Property Advisors.