Trending

HNA spent $45B over three years by tapping shadow banks

Chinese conglomerate bought 245 Park for $2.21B, is backing the Spiral in Hudson Yards

HNA Group is one of China’s biggest spenders, pouring $45 billion into global investments in just three years. To fund some of those deals, the conglomerate has turned to China’s shadow banking industry.

In addition to conventional financing, HNA has used a network of trusts, peer to peer loans and asset management products, according to an analysis of 100 investment documents and corporate filings by Bloomberg.

While not illegal, the financing is unusual and suggests it has been willing to take on expensive debt that would eat into profits. HNA’s return on equity fell to 1.7 percent last year from 3.6 percent in 2015, according to Orient Capital Research. “It’s questionable whether they’ll be profitable enough to repay the loans,” said founder Andrew Collier.

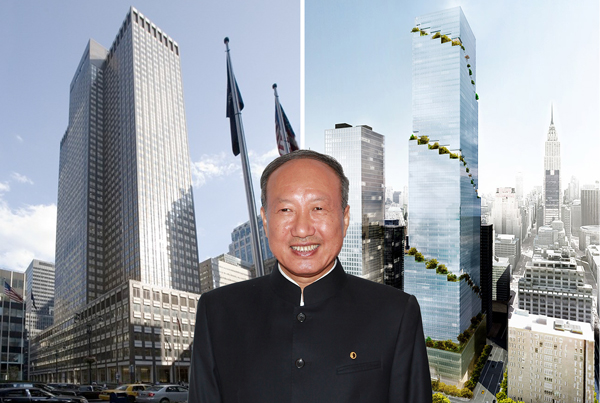

HNA made a splash in New York in March when it went into contract to buy a trophy office building at 245 Park Avenue for $2.21 billion (it closed on the deal in May). It is also backing Tishman Speyer’s $3.2 billion Spiral project in Hudson Yards.

According to Bloomberg, the company pledged more than $10 billion in unlisted shares to non-bank lenders. It’s also paid interest rates that surpass China’s benchmark rates.

HNA said financing from non-bank lenders makes up a “small” portion of its funding. The company said its credit limit from Chinese banks increased by $15 billion this year. “We are confident in our ability to create value for our shareholders,” the company said.

According to Bloomberg, among the funding streams tapped by HNA is trust firms, which take money from retail or institutional investors and re-lend those funds. HNA entities have also sold 35 trust products since January 2016, up from 21 over the prior five years, according to data from Use Trust. By contrast, Dalian Wanda Group sold just 10 trust products during the same time and Fosun Group sold none.

HNA has also tapped peer to peer loans. For example, an HNA leasing unit is raising 45 million yuan on a P2P platform that’s offering investors an 8.8 percent return over 390 days — twice China’s benchmark for one-year loans.

The array of funding is worrisome, said Collier. “They’re way off the deep end,” he said. “Their needs for capital are so great that, at the end of the day, they are going to as many people as possible.” [Bloomberg] — E.B. Solomont