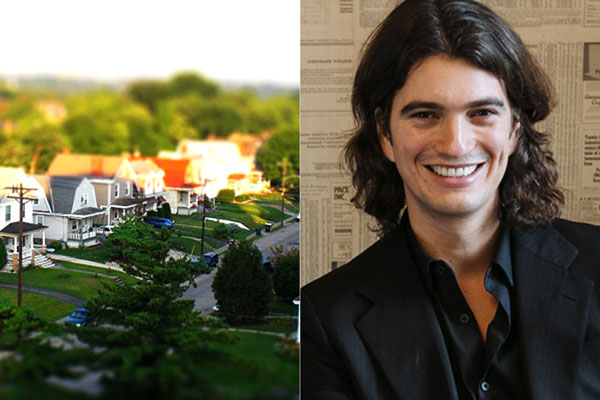

From left: Home sales and WeWork’s Adam Neumann

Co-working company WeWork gets a $4.4B investment from SoftBank

Japanese conglomerate SoftBank’s investment in WeWork is larger than previously reported. While various news reports earlier this year put SoftBank’s investment at $300 million and at $3 billion, reports now state that the co-working startup will be the beneficiary of $4.4 billion in capital, with $3 billion going to WeWork and another $1.4 billion put toward WeWork China, WeWork Japan and WeWork Pacific. WeWork, which manages 212 co-working spaces around the globe, has been valued at $20 billion.

[TRD] US home sales fell to a 2017 low in July

July saw a new low for national home sales, according to a study released by the National Association of Realtors. Homes sales dropped about 1.3 percent, hitting a seasonally adjusted rate of 5.44 million, the Wall Street Journal first reported. The low number of sales can be attributed in part to an intensifying housing shortage. The report found that number of homes on the market fell about 9 percent from the same time last year.

[TRD]

Federal judge clears Zillow’s “Zestimates”

A federal judge in Illinois dismissed a lawsuit by homeowners who claimed Zillow’s home appraisal algorithm generated “Zestimates” that undervalued their homes and made it more difficult to sell them. “The word ‘Zestimate’ — an obvious portmanteau of ‘Zillow’ and ‘estimate’ — itself indicates that Zestimates are merely an estimate of the market value of a property,” wrote Judge Amy St. Eve in her ruling.

[TRD]

Compass hires Facebook, Amazon vet as chief people officer

Compass, the investor-funded startup brokerage, has doubled its head count in the last 12 months, with 1,600 agents nationwide. Now it has hired Facebook and Amazon alumnus Madan Nagaldinne to oversee the company’s human resources strategy. Stepping into the newly created position as chief people officer at Compass on

Sept. 1, Nagaldinne will be responsible for recruiting, compensation, benefits, performance management and education at the rapidly expanding brokerage, which is valued at over $1 billion.

[TRD]Richard LeFrak still supports Trump despite “inappropriate” Charlottesville comments

Richard LeFrak, head of the LeFrak Organization and co-chair of President Trump’s now-disbanded infrastructure council, is sticking by his longtime friend. In an interview with

The Real Deal, LeFrak did say Trump’s comments on the white supremacist and neo-Nazi violence in Charlottesville were “inappropriate,” but argued that the president is not himself a white supremacist. “I would not even suggest that he is any one of those things,” LeFrak said. “But I can see why people would react to those words very viscerally. He’s made some effort to clarify it but not as far as he could have.”

[TRD]Canadians skate away from US trophy towers, shifting to multifamily and industrial investments

Canadian investors have shifted their interest from commercial office spaces to industrial and multifamily buildings, according to a new report from Real Estate Alert. Only 39 percent of Canadian investment in U.S. real estate has gone to commercial properties this year so far, while industrial properties made up 29 percent and multifamily buildings took another 27 percent.

[TRD]Stonemont Financial buys 100-property portfolio for $1.3B

Private equity real estate firm Oak Street Real Estate Capital sold a portfolio of 100 office, industrial and retail properties to Atlanta-based Stonemont Financial Group for $1.3 billion, the Wall Street Journal reported. Chicago-based Oak Street will continue to provide management services to the properties, which are spread across 20 states. CBRE brokered the deal and secured the financing.

[WSJ]MAJOR MARKET HIGHLIGHTS

Halstead Property ends automatic feed to Zillow-owned StreetEasy in NYC

Halstead Property joined at least 10 other residential firms this week when it announced it would stop automatically sending listings to StreetEasy, the Zillow-owned New York City-area listings service that has caused an uproar for its recent rollout of a number of costly new products and fees. Halstead will now send all of its roughly 1,000 sales and 600 rental listings to the Real Estate Board of New York’s new residential listing system, RLS. “We strongly believe the RLS syndication is an effective tool for streamlining the process of sending the most accurate and consistent data to listing aggregator websites,” said Halstead CEO Diane Ramirez.

[TRD] What does the Los Angeles residential market look like? Chart it by neighborhood and price

The average asking price per square foot in Beverly Hills is $447. Some 20 miles away in Canoga Park, it’s $170 per square foot. That’s according to an analysis by real estate research firm NeighborhoodX, which shows the range of asking prices on a per-square-foot basis for more than 20 Los Angeles neighborhoods.

[TRD]

There’s 2 years of excess condo inventory in South Florida

In Bal Harbour, Surfside and Bay Harbor Islands — the cities just north of Miami Beach — have two years of excess luxury condominium inventory, according to a new report from Condo Vultures Realty. Nearly 245 condos are currently listed for sale in the area, with 39 units sold in the first half of this year, the report found. Eight new projects are under construction, which will add another 300 units to the area’s market. [TRD]

Welcome to Seattle, Amazon’s company town

Amazon now occupies 19 percent of the prime office space in Seattle, a Seattle Times analysis found. That’s the highest percentage controlled by a company in any major U.S. city. Amazon, which has an 8.1 million-square-foot presence in Seattle, has more office space than the next 40 companies put together. The company has spent $4 billion on real estate in Seattle so far. The report estimates that the company will claim a total of 12 million square feet in Seattle within the next five years. [Seattle Times]