A survey of international office rental markets by CBRE found that Asian office markets dominated in rent prices; Manhattan was the only North American market to make the list – though the New York’s borough took up double its size by making it into the top 10 twice.

The survey noted that cities with IT and media hubs had the strongest growth in prime rents, largely thanks to co-working spaces. CBRE also highlighted that, while Asian markets were high, other markets had more steady growth.

Here are the top 10 most expensive places to set up shop:

1

Hong Kong (Central), Hong Kong

Annual rent of $269.26 per square foot

Central District, Hong Kong. (Mstyslav Chernov)

2

Beijing (Finance Street), China

Annual rent of $174.07 per square foot

Beijing, Financial Street. (Wikimedia Commons)

3

Hong Kong (West Kowloon), Hong Kong

Annual rent of $163.57 per square foot

West Kowloon, Hong Kong. (Pixabay)

4

New York (Midtown Manhattan), U.S.

Annual rent of $153.50 per square foot

Midtown, Manhattan. (Patrick Theiner)

5

Beijing (CBD), China

Annual rent of $151.87 per square foot

Beijing, CBD. (Morio/Wikimedia Commons)

6

London (West End), United Kingdom

Annual rent of $136.38 per square foot

West End London. (Steve Collis)

7

Tokyo (Marunouchi/Otemachi), Japan

Annual rent of $132.09 per square foot

Tokyo, Marunouchi/Otemachi

(663highland/Wikimedia-Commons)

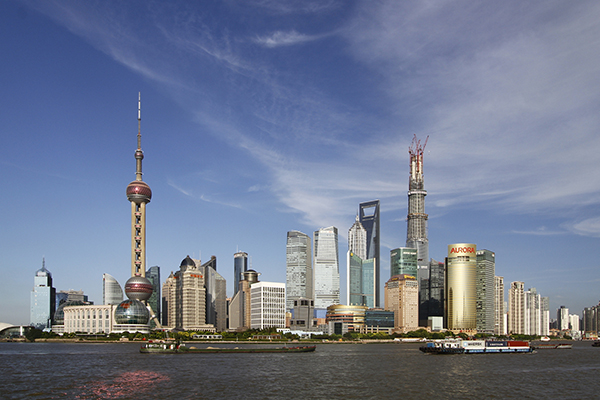

8

Shanghai (Pudong), China

Annual rent of $120.11 per square foot

Shanghai, Pudong. (Pierre Selim)

9

New York (Midtown-South Manhattan), U.S.

Annual rent of $113.53 per square foot

Midtown Manhattan, South. (Bartek Roszak)

10

New Delhi (Connaught Place – CBD), India

Annual rent of $110.85 per square foot

Connaught Place, New Delhi. (Lokantha/Wikimedia Commons)

[CBRE] — E.K. Hudson