The world’s population is getting richer, and they want to spend that wealth on luxury real estate.

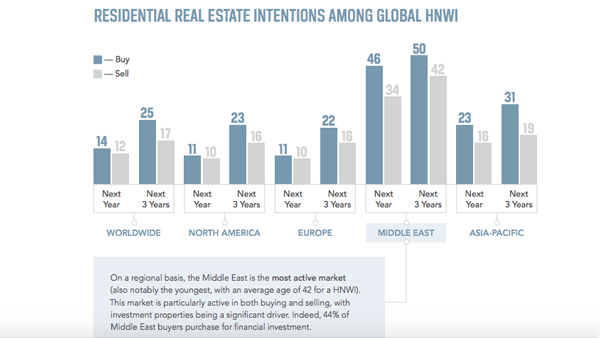

The international luxury residential market will see more demand than supply over the next three years, with 25 percent of high-net-worth individuals expected to buy high-end real estate compared to the 17 percent who want to sell, according to a new report from Luxury Portfolio International, a conglomerate of more than 200 brokerages around the world.

The report also noted the numbers of wealthy people across the world is going up.

There were 1.6 million households around the world with more than $10 million in net worth during 2016, according to the Credit Suisse Global Wealth Databook. That figure is an 11 percent increase on 2015 and a whopping 91 percent increase since 2010.

Buyers and sellers in global luxury real estate (Credit: Luxury Portfolio Global luxury real estate report, click to enlarge)

Most of the world’s wealthy consumers live in North America, with the number of $10 million-plus households increasing 146 percent in the last even years. Europe is the second largest “wealth region” in the world and is home to nearly 20 percent of the world’s wealthy households.

The Asia Pacific region has seen an explosion of wealth, with the high-net-worth individuals in that part of the world increasing more than 20 percent between 2015 and 2016. China is producing 100,000 new millionaires each year, according to a report earlier this year from Knight Frank, but there is concern about that country’s new capital controls will impact investment in the U.S.

Despite the report’s rosy outlook for the international luxury market, New York City continues to experience an excess of high-end product. Luxury Portfolio’s International’s figures indicate Manhattan sales over $10 million in the first half of the year increased 12 percent from the same period the year before to hit a total of 192. However, that jump is driven largely by both closings from contracts signed in 2014 and luxury sellers’ growing willingness to negotiate on price.

In Los Angeles this year, there were 65 sales in the $10 million to $20 million range, up from from 50 during the same period of last year, according to data supplied by the brokerage Hilton & Hyland. There have been 23 sales in the over-$20 million market in the city so far this year.

In Miami, there have been 46 properties sold in the over-$10 million market so far this year, according to Keyes Realty.