“When in Rome” appears to have gotten lost in translation when it comes to Manhattan’s office market.

Foreign owners are ignoring the custom set by Manhattan’s real estate families, real estate investment trusts and private equity owners of offering pricey incentive packages to lure tenants, according to a new report from Colliers International.

“Foreign owners oftentimes have a longer term perspective on their investment with less pressure to maintain starting rents at a certain level,” Colliers executive director Craig Caggiano told The Real Deal.

As new construction has come online in places like the Far West Side, Lower Manhattan and the outer boroughs, landlords have increasingly sweetened the pot by offering things like free rent and tenant-improvement dollars to build out spaces in order to compete for tenants.

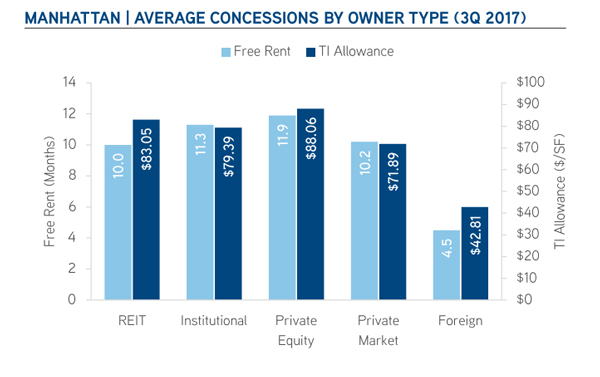

Overseas owners were offering an average of 4.5 months of free rent during the third quarter, essentially on par with the free-rent period they offered before the Great Recession. They were also paying out an average of $42.81 per square foot in cash contributions, a 48.5 percent increase over the third quarter in 2008.

Other ownership types – defined by the majority owner in a property – were reaching deeper into their pockets.

Private equity owners are the most likely to spend big in order to attract a tenant. During the third quarter they were offering an average of $88.06 per square foot in cash incentives, a whopping 307.9 percent increase over the same period nine years ago. Private equity owners were also offering nearly a full year – 11.9 months – in free rent, an increase of 250 percent over late 2008.

Real estate investment trusts, institutional owners and private landlords have seen their concession packages more than double since the Great Recession.

Among Manhattan’s three submarkets, concessions were greatest in Lower Manhattan – an average of 9.9 months free rent and $75.21 per square foot in tenant allowances – as landlords started bulking up concession packages post-recession to draw tenants the reinvigorated neighborhood.

“In order to bring those tenants to Lower Manhattan, they started offering very generous concession packages,” said Brian English, Colliers’ senior director of research. “That theme will continue as large tenants relocate downtown.”

Manhattan’s average asking rent topped their pre-recession levels a year ago, but have since dipped slightly to an average of $72.87 per square foot in the third quarter. Colliers forecasts that as interest rates rise and it becomes more costly to give tenants cash to build out their space, landlords will rely more on free-rent periods to keep face rents steady.