IBI, an investment firm in Israel, gave a thumbs up to U.S. real estate companies trading on the Tel Aviv bond market, with a few caveats.

The company released a report Wednesday providing investors with guidance on the sector and recommended five companies in particular.

“This is an opportunity to make order and remind [investors] that not all American companies are of a piece,” IBI wrote in the document.

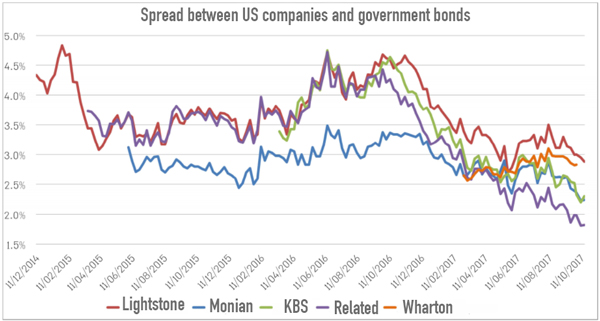

The five companies highlighted by IBI were the Moinian Group, Related Companies, Jeff Sutton’s Wharton Properties, the California-based KBS, and Lightstone Group. In terms of performance, all five have seen their yield spread trend downward relative to government bonds, demonstrating increased investor confidence in the firms over time.

Nevertheless, the yields remain higher than comparable Israeli companies, presenting an opportunity for investors to exploit. The report puts the average yield spread at 2.4 percent for the five American companies and 1.2 percent for comparable Israeli ones.

Wharton has the shortest track record, having entered the market in January. The Wharton portfolio is strictly retail but is protected from the retail slowdown by its prime locations and because it’s locked into long-term leases with built-in rent increases, according to the analysis.

Lightstone has made three substantial multifamily purchases outside New York in the last several months, which will increase its portfolio by 2,900 units for a total of $257 million, and thus its income flow is expected to increase substantially.

A slew of new U.S. companies have entered the market, at varying levels of quality, over the past few months, and the Tel Aviv Stock Exchange introduced an index to track them.